Ride the waves

of the stock market

AND become a profitable trader

What is big wave trading?

stock chartS & patterns

We provide an overview of stock chart trading patterns, general market conditions and an updated watchlist of stocks with big potential moves.

Video Library

We provide weekly video recaps and commentary on our latest positions and market conditions that make it easy to learn and follow our trades.

LIVE chat room

Join our stock trading chat room where Joshua Hayes and our members discuss the market and trade ideas in real time.

Years Experience

Members

Market Updates

Trades

14 Day Free Trial!

Market Commentary

Educational Course & Mentorship

6 week long Hand-Held Mentorship with Joshua Hayes (Big Wave Trading) who has been trading for over 20 years and Denis, a day/swing trader who has been trading for 10 years SPOTS ARE LIMITED WHAT YOU RECEIVE: 💥40+💥 LIVE Lessons ranging from trading 101 to the money...

read moreBulls on Parade

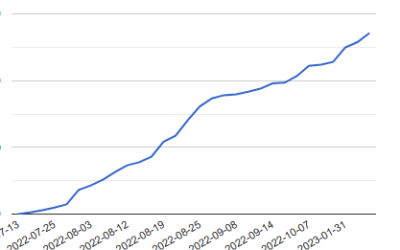

Stocks Continue to Push Higher, Crypto Currencies Breakout As the Federal Reserve continues to pump free liquidity into the financial markets, stocks have continued to push higher and higher. The free liquidity appears to be a constant for this market until inflation...

read moreBulls on Parade

Bullishness remains high We continue to see a higher number of bulls in the stock market given the all-time highs. Many are chasing this market higher as they are likely worried about missing out on a stock market rally. We do not chase price as we know buying...

read moreFollow BigWaveTrading on Twitter and StockTwits