The overall market continues to lack any clear direction with individual stocks in my personal holdings looking pretty darn strong/solid overall but the overall market/tape looking quite problematic. The MACD and RSI(14) oscillators are all still trending lower on every major market index, the indexes are still building a series of lower highs and lower lows, and the market refuses to close strong. Every single session, minus one session, since 3/21 has come with the market selling off into the close. The exact opposite of a strong market that is consolidating its pullback well.

The good news is that the SP-500, Nasdaq, and DJIA all appear to be consolidating in an orderly fashion. Too bad the Russell 2000 and DJ-Transportation average are not. Both indexes are below their 50 DMAs and both indexes have failed to retake it already once. If the pullback was a “good” pullback, we would be seeing the RUT and DJT leading while the DJIA and SPX bided their time. Still, until these indexes, or any of the indexes as a matter of fact, decide to break through their March lows we are still trending higher and I will invest/act accordingly.

I do not like what I see in regards to the overall market and feel like I am pulling teeth trying to find reason to be bullish. The best I can come up with is that the tape is still holding up overall (barely) and my long positions are still holding up well overall. The NYSE advance/decline line also is near new highs so that is another positive. Still, overall, not a whole lot to hang your proverbial hat on, if you ask me. One day of strong selling, would knock out all of the three “positives” that I currently see.

On the sentiment side, it’s nice to see the bullishness pullback a bit but we still have a pretty complacent crowd. The VIX is near 13 (no fear). The CNN Fear&Greed index is at 40 which is a “fear” level but nowhere near the contrarian 0 number. The NAAIM exposure index has come down to 67.47 which is quite a pullback from the 100 level a few weeks ago. Still nowhere near fear. The AAII bull/bear is at 28.3% bulls to 39.6% bears but the AAII survey is basically worthless unless it is confirmed via every other sentiment gauge. More importantly, the II survey is 55.8% bulls to 18.3% bears. Hilarious!

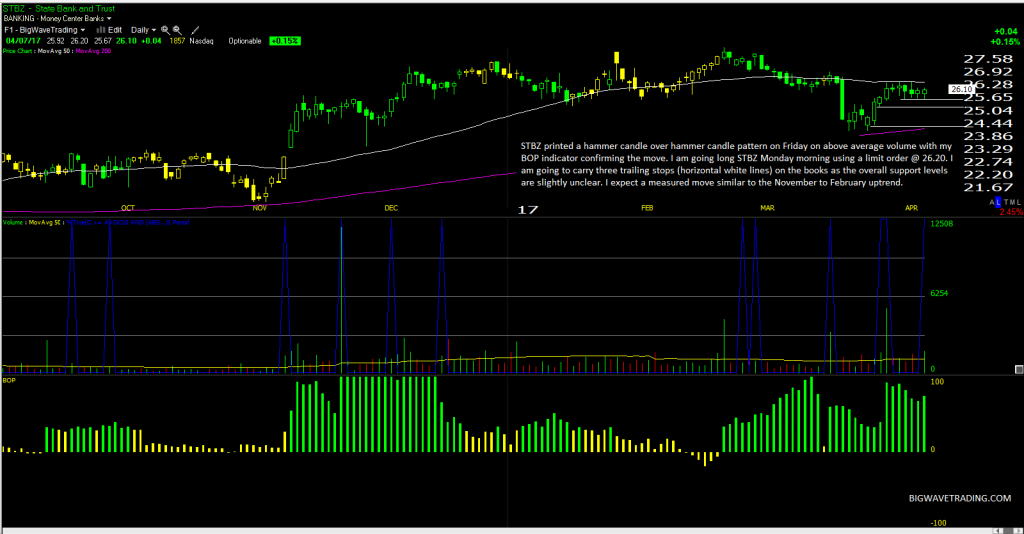

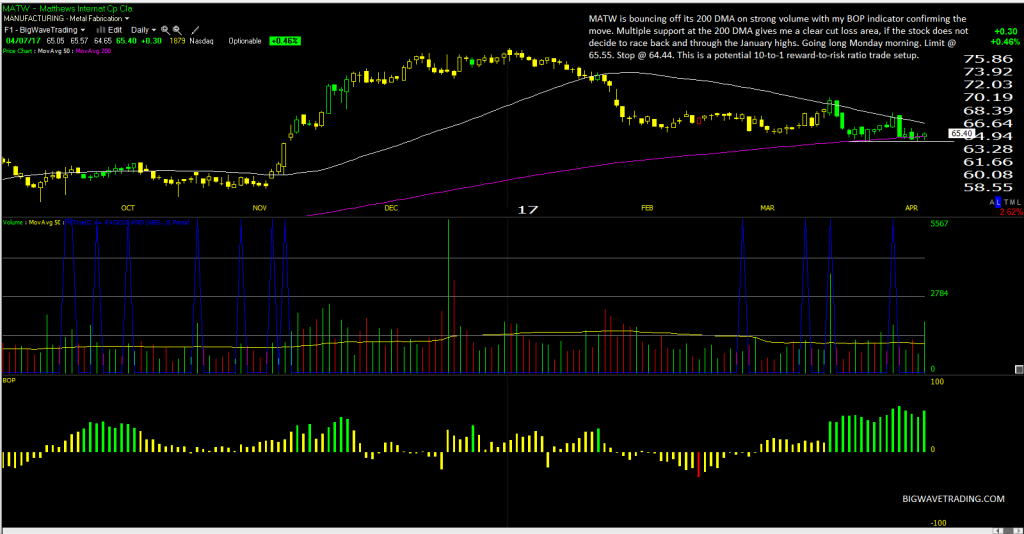

It is important to keep all of this in mind when deciding to take new long or short positions here. I have three new long positions (two posted below for non-members) this weekend but in regards to the overall tape and the quality of the stocks and their signals we are not talking about anything potentially game changing here. I am simply following my rules per nearly 20 years of stock market experience. Every trade has great potential reward to extremely limited risk ratios. None of the new longs are CANSLIM quality but they are all higher priced quality stocks that made my main price/volume surge scan and all are definitely worth taking a limited position in.

As you can see below (members only), there are only three partial EOD sells. One for a 20% gain, one for a 1% loss, and one for a 2% loss. That is how you do it. Over and over and over. In time, it adds up exponentially. Keep those losses small and the victories will take care of themselves. We have some important earnings next week from some big names like JPM, C, WFC, DAL, TSM, and PNC. It’s definitely going to be an interesting earnings season. Buckle up buttercup. Have a great rest of your weekend and I’ll see you back here on Monday. Aloha from the absolutely beautiful island of Maui.