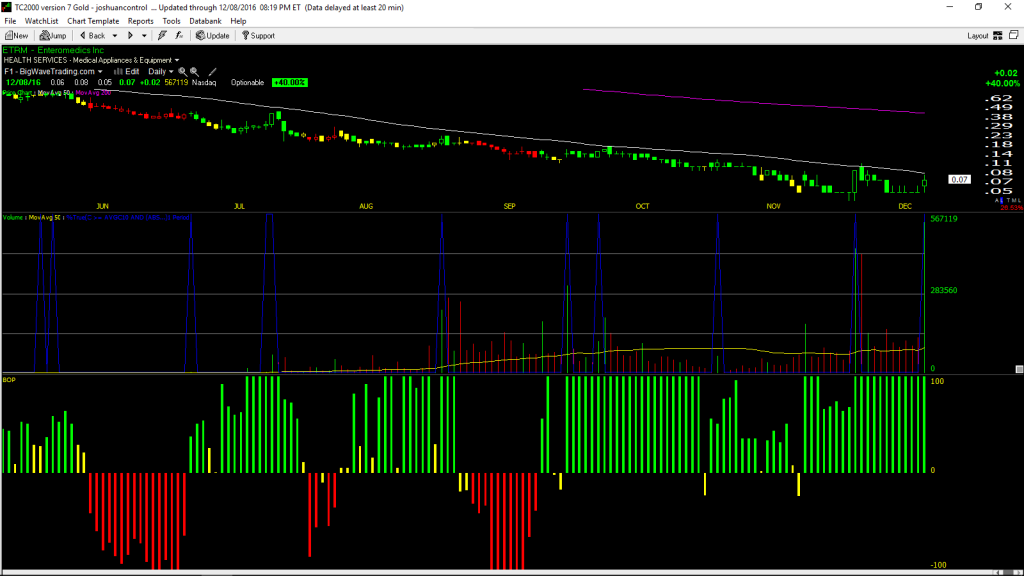

This is an odd update as I am now watching ETRM as a potential short if it gaps open and runs too much early on. However, if it does not run in the morning following its gap up (if it does indeed gap up in one hour) I am going to attempt to get it with a limit order at Thursday’s closing price. So this is why it is listed as a potential short in the daytrading watchlist update but is an overnight oversold turned momentum RSI/MACD play.

New Speculative Long Positions: SAEX (0.5%) ETRM (0.25%)

SAEX – Suggested final cut loss/sell stop levels: 8.00 and 6.02 (emergency final cut loss; doubt this comes into play). Profit targets: 12.17 and 19.11.

ETRM – Suggested final cut loss/sell stop levels: 0.05 and 0.04 (emergency final cut loss; doubt this comes into play). Profit targets: 0.17 and 0.45.

Speculative Sells:

50%: SSH – Locking in half of a 200%+ profit in two days, this is how I wished they all worked.

100%: NEOT GEVO CBAY – Fail, cutting small losses on all positions.