Today was a decent start to the week as the Russell 2000 lead the stock market higher. Volume was higher across the board as institutions were able and willing to accumulate shares. News of North Korea launching a missile continued to dominate the headlines, but the stock market did a nice job of shrugging off the news. There are so many stocks looking good it is hard to believe we will experience any sort of correction any time soon. Of course, this may change as conditions change. However, we are looking good with this uptrend. A solid session all around and we are not going to complain.

Materials, Financials, and Energy all were leading sectors today. Energy received a boost from higher oil prices as the Saudis and Russia agree on output cuts. Crude curtailed its gains at the close, but remain near the $49 mark. Construction Materials group was largely responsible for the move in materials with VMC and MLM gaining 2% on the session. Financials continue to benefit from the Federal Reserve rate hikes. June odds have come down from 100% to 97.5%. While the market is predicting, rates move higher June or July it is undecided to when the next rate hike after that will take place. Not the high-flying industries you want to see moving, but at least we are seeing healthy gains.

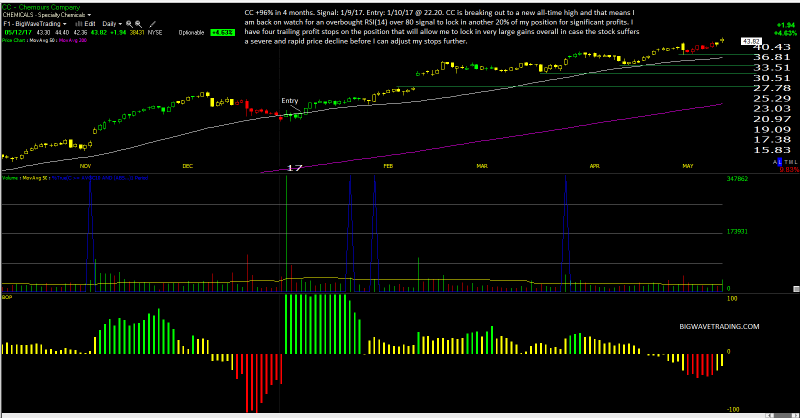

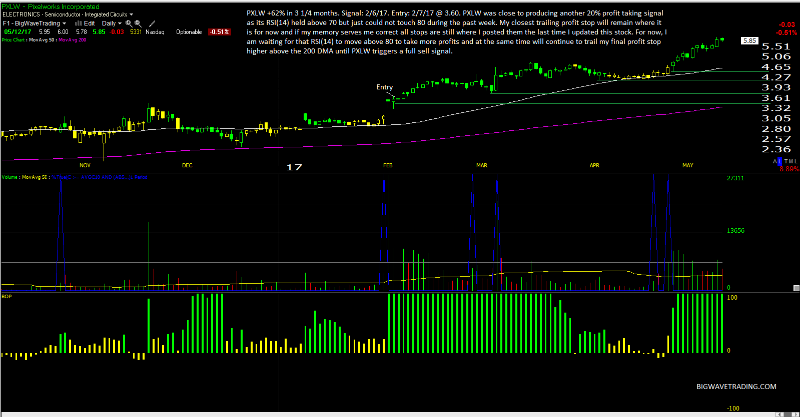

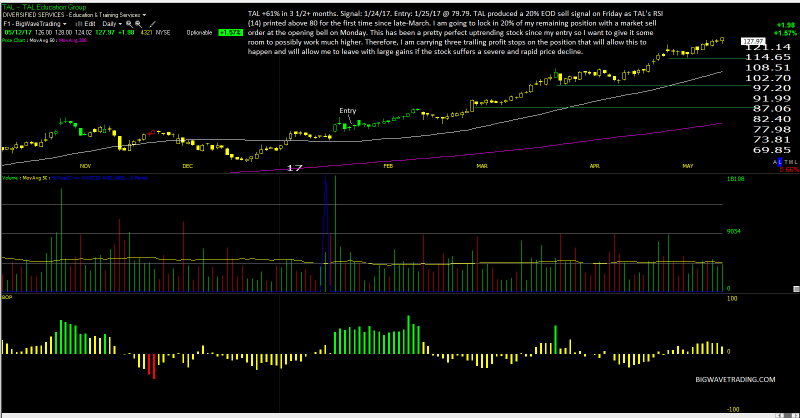

Here is a look at some of our top current holdings and how we are playing them currently:

There is no real reason to continue to call a market top. Hitting all-time highs is a bullish. Sure, someone at some point will call a market top. However, they will be wrong up until we do top and we could be waiting a very long time. Focus on getting your money management right and making sure your losses are cut short. Do not wait too long and have large losses. It will destroy your hard-earned capital.