Small cap stocks rose once again leading all indexes while bonds were hit hard by sellers. Bonds are certainly trading like the Federal Reserve is going to hike rates soon. Global yields also rose as the ECB president spoke earlier today. Russell 2000 was the leading index gaining more than one percent on the session. We continue to see this market inch higher making very little progress, but we are moving higher. Why try and fight this market at the moment? Until we see our holdings falter and distribution pile up there is no real reason to hop off the bandwagon just yet. Friday we get May’s job report and the way things look now it appears we will just continue to march higher. Stick with price.

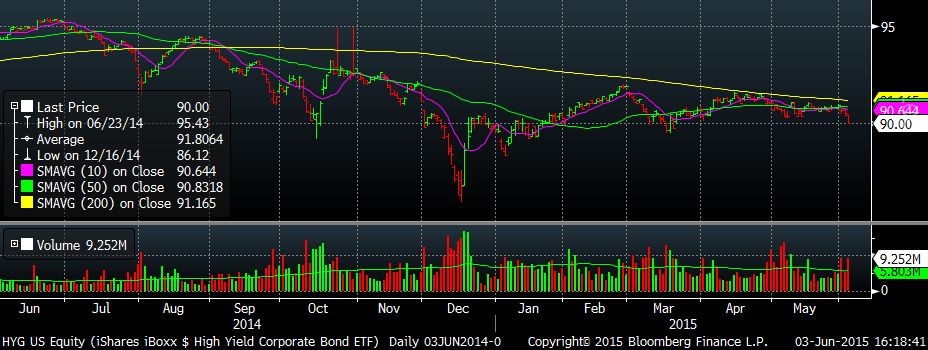

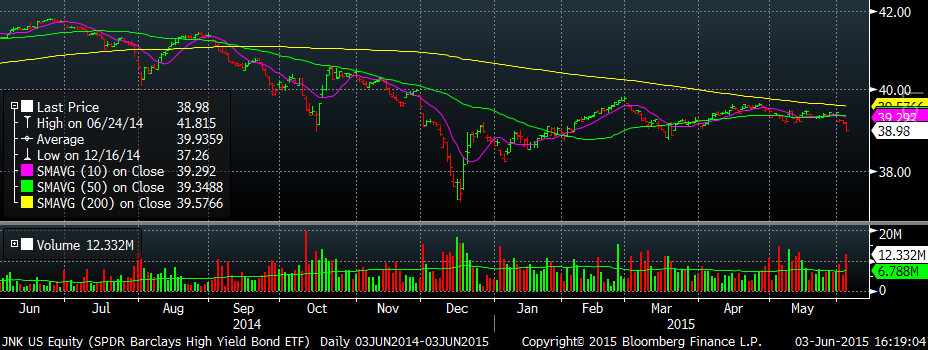

Bond yields are certainly telling a much different story than stocks at the moment. High Yield debt took a big hit and just looking at HYG and JNK you can see the damage the move in yields did. Junk debt or high yield debt is a great precursor to how stocks will react. While not a perfect indicator it can foreshadow things to come. We are in an uptrend without evidence of imminent danger. However, the move in HYG and JNK certainly is precarious. TLT also shows the severity of the move in bonds today.

There isn’t anything sticking out like a sore thumb from our holdings stand point that says we are in danger of a stock market correction. Everyone is certainly trying to be the one to pick the top. Sure, there are plenty of great bear cases including margin debt and Dow Theory (Dow Transports diverging). Price is the master of all indicators and while these are anecdotal we simply must stick with price action and our holdings. Avoid trying to outsmart everyone and pick a top. Stay with the trend until there is a clear signal it is over. Our signal is our holdings and distribution across the indexes. Keep it simple and stick with price.

Try and not overthink this market. It is far too dangerous. Cut those losses short.