Turnaround Tuesday went in the opposite direction today with stocks falling on higher turnover as small cap stocks once again lead to the downside. Just after the announcement of the new product lineup out of AAPL it appeared as if this market would rally. However, sellers simply were not going to have any part in a rally today. From 2pm EDT on the selling was relentless. It wasn’t until the last 30 minutes to where sellers lifted their foot off the gas. During the past five trading days we have now seen two sizeable distribution days on the NASDAQ. In addition, we have a few breakdowns in a few leading stocks throwing up a few warning flags. While we are not throwing in towel on this rally just yet, it does appear to be on shaky ground.

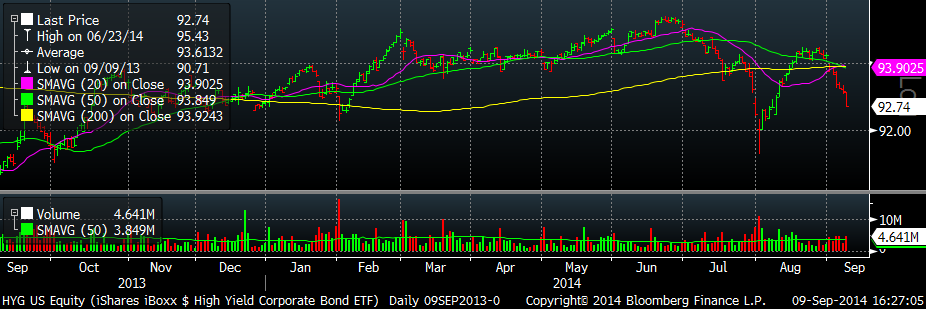

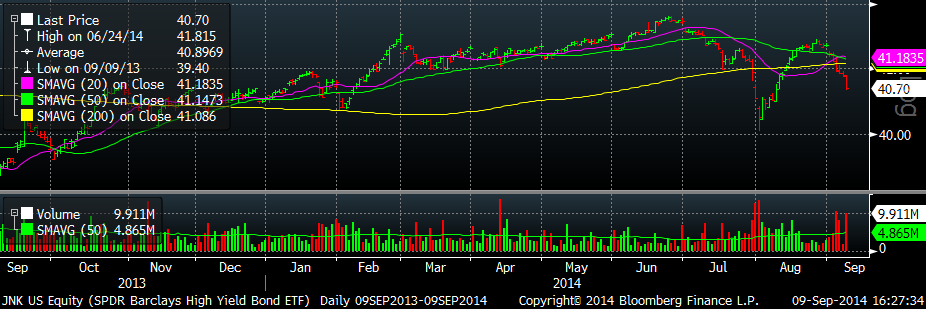

A big warning flag is coming from the High Yield market. We have in the past shown the High Yield market can signal well ahead of equities. Zerohedge is typically well ahead of the curve with pointing out the warning signs. A bad sign is how both HYG and JNK have reacted after bouncing from their August lows. Both bounced hard, but now have rolled back over and they appear to be heading back towards August 2014 lows if not 2013. Here are the two charts where you can see the fall:

A few more warning signs coming from leading stocks like PCLN are troubling. PCLN is now rolling over and appears to be heading much lower. The stock is below major moving averages like the 50 and 200 day moving average. Another danger for the stock is these major moving averages are beginning to roll over. This typically is not a good sign. An easy way to track leading stocks would be tracking the ETF PDP. PDP tracks a momentum portfolio of stocks and when these roll over the rest of the market tends to follow suit. In our chat room we have discussed a few more leading stocks breaking lower and they do have us on alert.

AAPL had quite the session today. The stock saw a huge push in volume, more than three times its normal volume today. The stock did end lower, but at one point it appeared we would see the stock make a fresh new high. Unfortunately, sellers were not having any part of new highs. The stock is broken for now and news some work to offer up another buy point.

Any follow through selling would not be good for this market. Revisiting and holding the high on the NASDAQ set on September 3rd would be a good sign. Until then, we will continue to work within our strategy.