Thanks to big moves in some Dow components like JNJ and IBM the old blue chip index is powering ahead despite sluggishness in the NASDAQ and Russell 2000. The market was greeted this morning with decent economic data with only the Richmond Federal Reserve manufacturing index disappointing. Shortly after the 10am economic data release the selling began and it was concentrated to the NASDAQ and Russell 2000. You can certainly see the shift in bias towards the Dow with it holding up well and the NASDAQ/Russell 2000 having a difficult time here. Perhaps this is just rotation and the big blue chip stocks are going to be our leaders going forward. Time will tell and so far price is indicating the Dow is the place to be.

Volume was considerably lower than yesterday’s session; it is giving a hint institutions weren’t all that interested in scooping up shares across the NYSE and NASDAQ. JNJ certainly got a nice boost in volume as well as IBM. However, there weren’t that many high volume moves for much of the market. This doesn’t necessarily spell overwhelming trouble for the markets, but something to pay attention to. Another big volume move was in PLUG. Its industry has been hotly contested amongst pundits. Many are questioning the viability of the fuel cell industry, but given the recent move someone believes in it. PLUG, BLDP, FCEL etc. bring back memories of the dot com bubble and those who were around back then are quite scared of a repeat. Remember when airlines were not to be owned? Some airlines have been great winners: DAL, UAL, SAVE, ALK, and there are more. Opinions are just that, but price is everything.

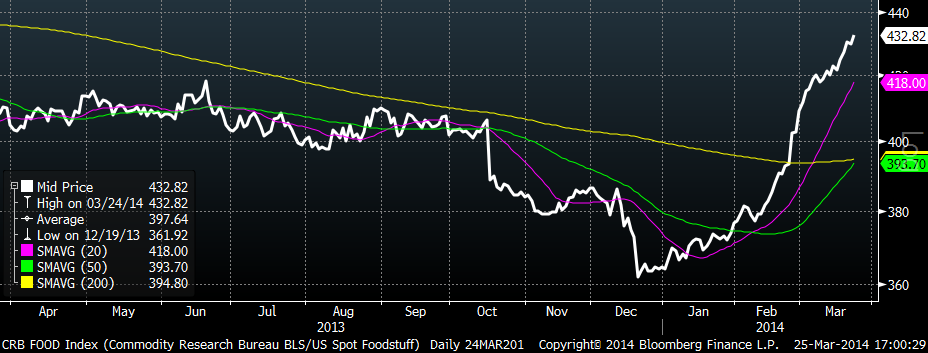

This market is still in chop and slop mode and while the market does appear weak (IWM, QQQ) we aren’t out yet (DIA, SPY). The Federal Reserve is still pumping $55 billion of free money to primary dealers and this money has to go somewhere. If it is not stocks then where? Check out the recent move in the CRB Food Index. This should bode well for the poor:

Always pay attention to where money is flowing to. Commodities have been doing well as of late and price was a big indication prior to the advance!

We’ll continue to plug away at our process. If we are meant to roll over we’ll get right aboard the trend. Conversely, if we breakout we’ll follow right along with it too. Be prepared for any situation and do not hesitate to act on a proper signal.