AAPL hit another all-time high today along with AMZN sending the NASDAQ to another new all-time high as well. We continue to see strong moves in the NASDAQ 100 as earnings season continues to roll. While earnings continue to hit the wires, many will be paying close attention to the Federal Reserve and if it will remain dovish given the weak economic data since its last meeting. We are not going to guess how the Fed will act nor guess what they may say. Now, we continue to see strength among NASDAQ 100 names and they continue to hold up this market. A solid start to the week and we’ll look to build upon today’s action throughout this week.

We would have loved to see the market rest a few more days prior to the Fed announcement Wednesday afternoon. Consolidation always helps build momentum for higher stock prices. Regardless, the worse thing we can do is argue with what we have in front of us. No sense in rowing upstream. Do not fight this trend. Continue to roll with it like we have and continue to profit.

Again, the lone blemish on this market is the lack of interest in the Russell 2000. Traders are simply not interested in small cap names. Who knows why and let’s have others try and figure it out. Sure, underneath we have plenty of stocks moving within the index. However, you would like to see the interest as it shows traders have an appetite for risk. Now, the NASDAQ 100 is acting like the Dow used to when traders were looking for “safety” when they were unsure of the market. If you control risk and manage exits properly there is no reason to fear anything the market has in store.

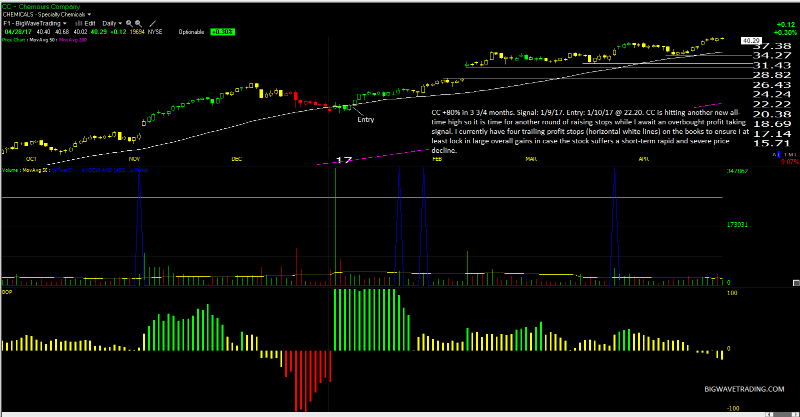

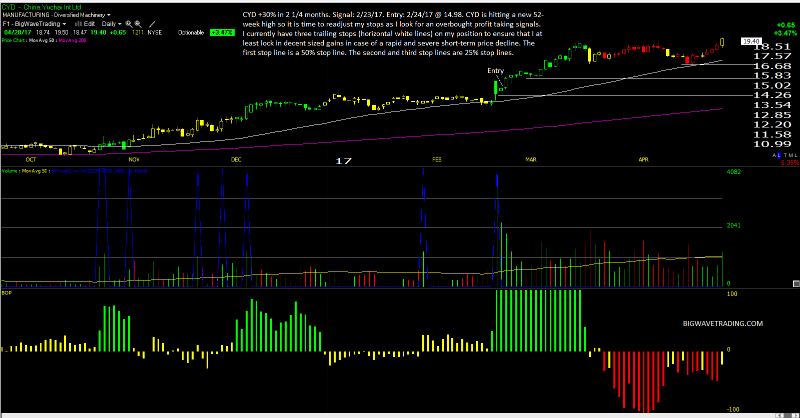

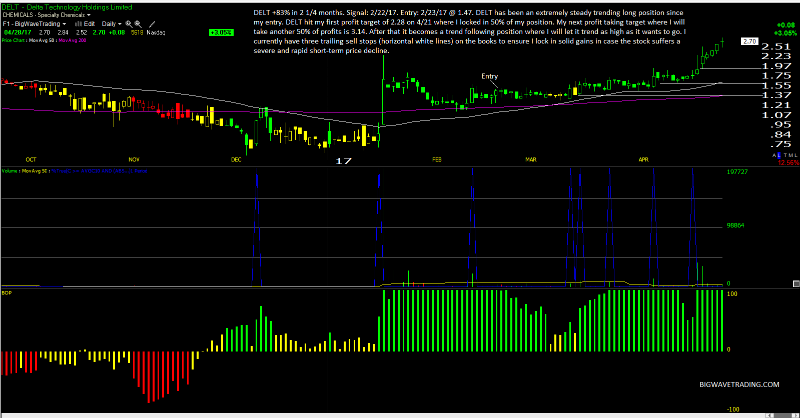

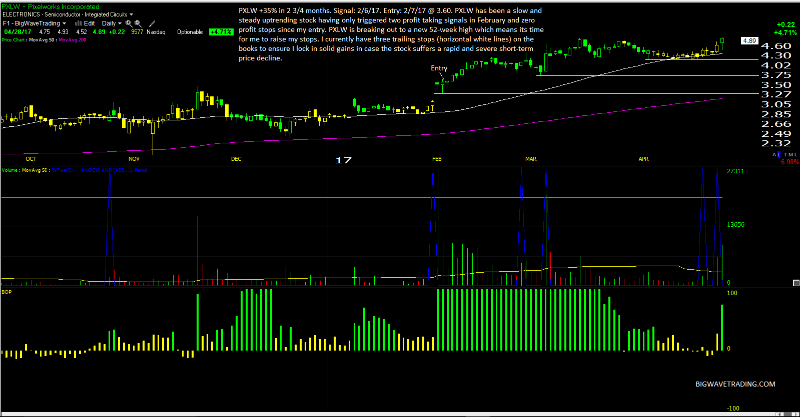

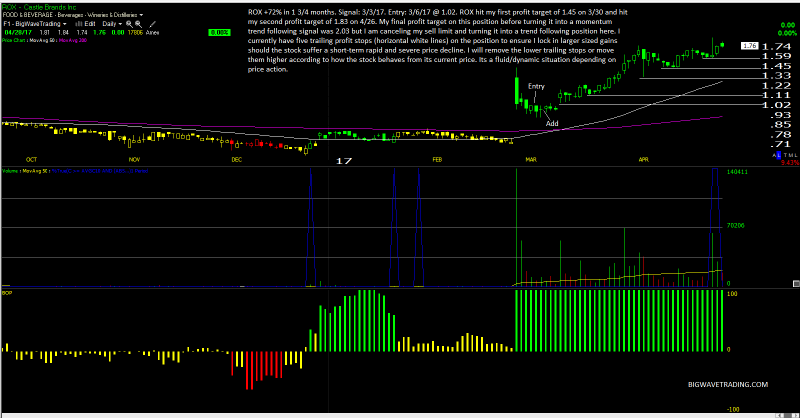

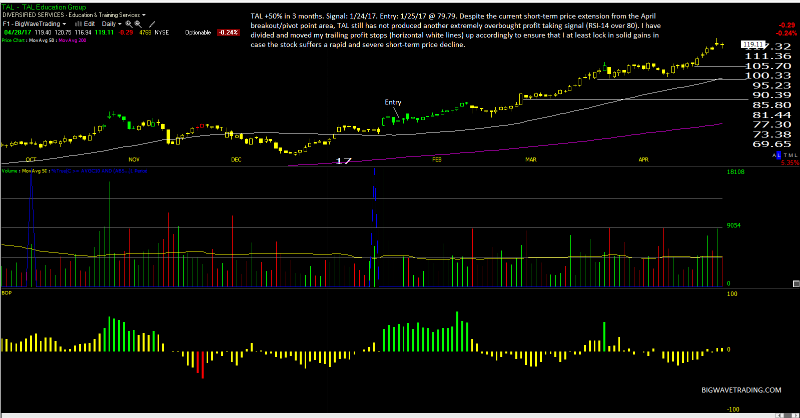

Here is a review of some of our top current holdings and where our stops are currently place. Enjoy!:

A good start to the week for the stocks. We hope you have a profitable week!