Stock indexes staged another bullish intraday reversal on Friday with the Nasdaq and Russell 2000 leading the move to the upside. Unfortunately for the bulls, the market’s inability to rally at the start of the day following the bullish post-jobs gap up was more notable. On top of this, the two intraday reversals the past two sessions have come within a rather overall small intraday range. So there really is nothing that impressive about that feat. The bullish reversal on Friday also came with volume coming in mixed on the indexes. Another sign of nothing too special. Overall, it was good, but it definitely was not great.

It should be duly noted that I have been absolutely correct in my overall analysis in regards to the market on the short-term. I have been worried about sentiment for a while now and it is all starting to finally materialize in the overall market. During the past two weeks, I have gone from fully invested to 75% invested increasing my hedges along the way. If the market heads back higher right away, I will put the capital raised from selling laggards into the new leaders. If the market continues to sell off, I have my trailing profits stops on my current holdings and will continue to reduce size to new long signals.

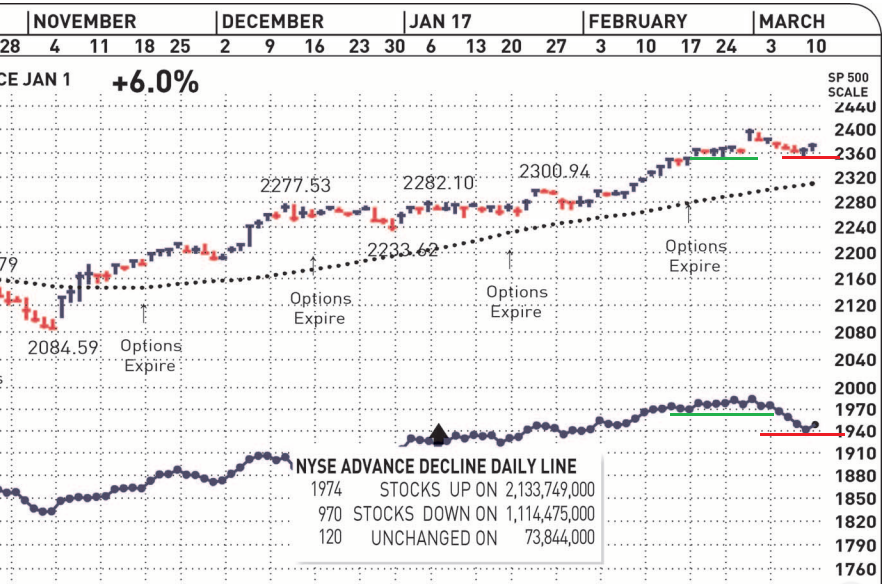

When/if the long signals completely dry up and my top stocks start hitting my trailing stops then you can be 100% sure this uptrend is done. For now, based on my current holdings, it is still good to go but there are some serious issues developing internally that I simply cannot ignore. Just like I could not and still cannot ignore the overall bullish sentiment, I cannot ignore this. The NYSE Advance/Decline line (chart below) is rolling over quite dramatically along with High Yield Bonds. This combination of events, along with the overall bullish sentiment and the obvious rapid decline of healthy looking stocks in my long scans is more than enough reasons to tread carefully here.

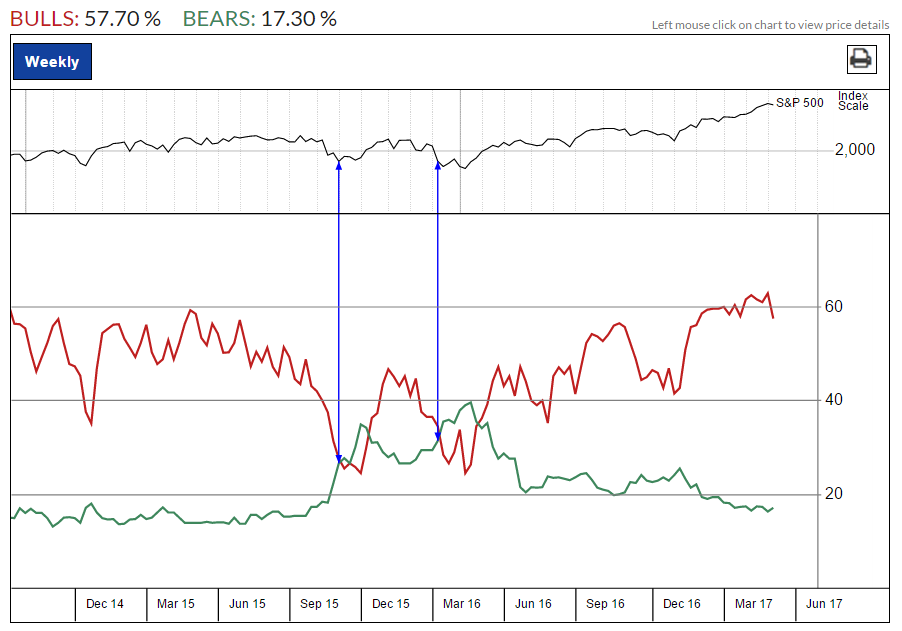

Just a quick reminder on the sentiment front, while the AAII bull/bear is currently 47% bears to 30% bulls, every other sentiment gauge I track is reversed. The II survey is 58% bulls to 17% bears–HA (chart below)! The NAAIM exposure index is still a frothy 87% long, the CNN Money Greed/Fear index is still “greedy” at 66, the VIX is only at 11.66, and the IBD Put/Call ratio fell to 0.85 on Friday. There is no fear anywhere and there is zero bearishness outside of the AAII survey. There is a time to be extremely bullish and there is a time to be cautiously bullish. This is definitely a time for caution as the overall uptrend is still in tact but the cracks are clearly starting to grow.

All of this is leading up to the FOMC meeting on Tuesday and Wednesday where the Fed is expected to raise rates another 25 basis points. My bias, due to my portfolios being 70% long, 25% cash, and 5% short, is on the bull side. I am “hoping” that the market is pricing in the rate hike and that once it is out of the way we will be good to go again. Unfortunately, the technical patterns in my top scans do not confirm my wishes currently. That could easily change but for now a lot of work needs to be done not only in the technical patterns but on the sentiment side. Hard to think we rally much here with the overall sentiment and technical patterns right now. They both need a lot of work.

This market is definitely not out of the woods yet and I will always advise against trying to catch falling knives. I recommend waiting for this market to build a real decent floor, preferably with a follow-thru day, before deciding to swing for the fences. It’s possible things could get very ugly as the geopolitical environment is absolutely disastrous and nothing short of a gigantic mess. It’s ugly. Let’s just hope this doesn’t effect the longer term uptrend. If it does, I have my contingency plan and will not hesitate in executing it. Enjoy the rest of your weekend. Trade smart. Aloha.