Let’s take a quick holiday weekend peak at some of our current winning long positions. Why not review any losing positions? Because we have them and when we do we stop out or cut our losses immediately. There is not any wishing or holding on to losing positions. They are always eliminated. Therefore, instead, let’s focus on what the winners look like knowing that there will always be the occasional loser that we must cut our losses on and move on.

While I do not recommend following my trading recommendations and always recommend everyone make their own personal decisions, following my trades is a simple process for busy professionals or new traders. I scan for new positions every evening, I make my selections based on my own personal criteria that I teach on the website, I post the trade recommendations to the website telling you where I am going to enter and exit the trade if I am wrong, I enter the orders that evening before the market open, I check the orders and make any adjustments before the opening bell, and then I execute my trade recommendations.

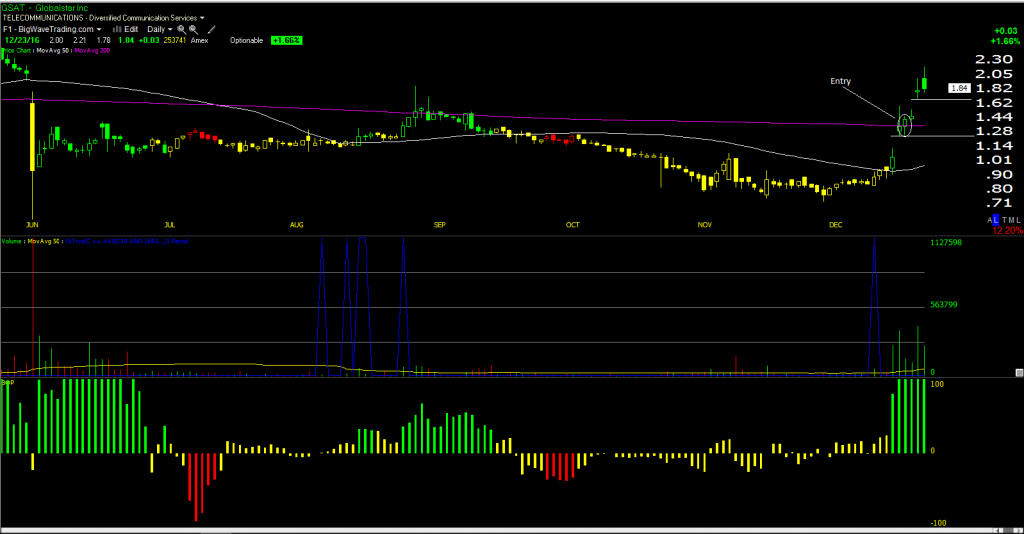

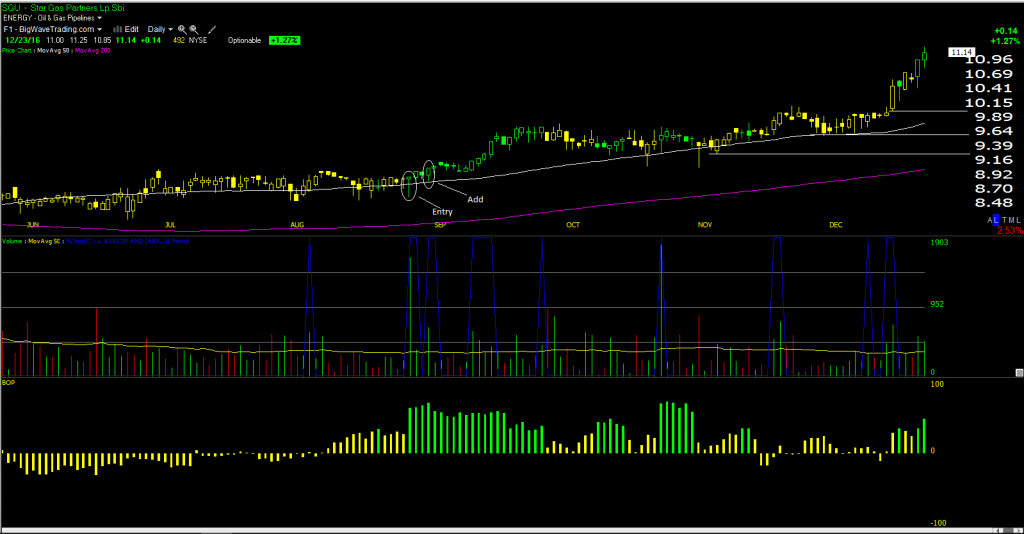

Below you will see a quick summary of some of my current long positions, where I entered, and where my current trailing stop levels are at this moment. These stop levels will be adjusted based on the way the stock trades through its 20 and 50 day moving averages and/or key support levels. For now, this is where they are at. SGU triggered a 20% profit taking signal Friday morning following its extremely short-term extended move higher in overbought territory (RSI-14 is above 80 currently). GSAT has already hit 50% of my profit targets with my first sell limit at 1.88. My final profit target is 3.00. I doubt it gets that high but it is where my final sell limit is currently placed.

If you are looking for a time-saving high reward/low risk way to invest/trade the market and are looking for one-on-one education, you are more than welcome to take a two-week free trial. I look forward to seeing you in our chatroom and on the website. Have a great rest of your holiday shortened week. Merry Christmas and Happy Holidays.

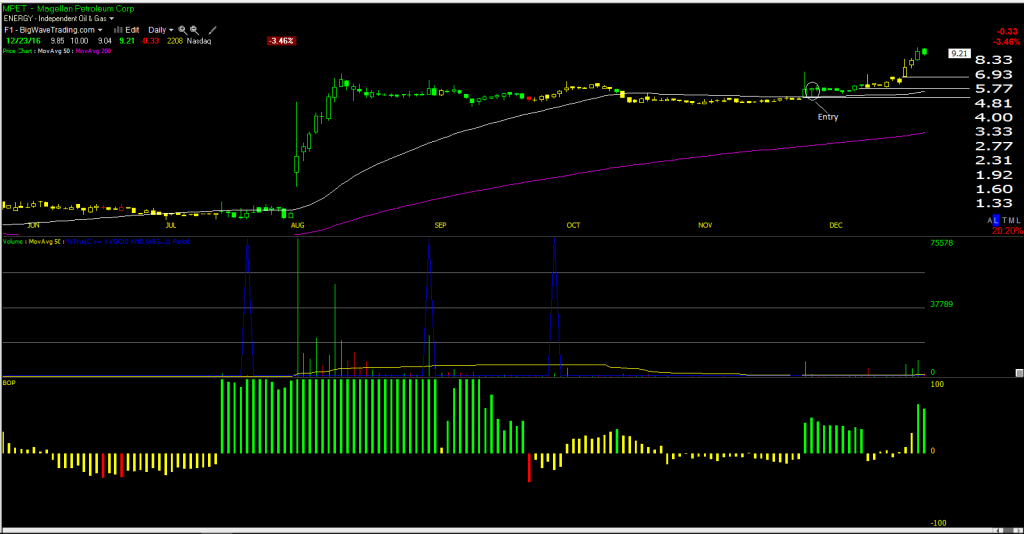

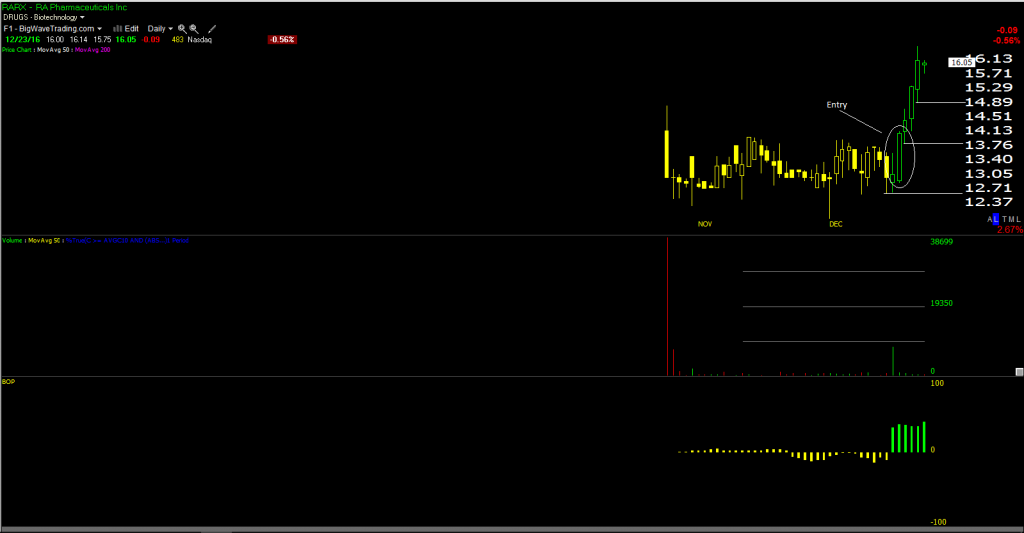

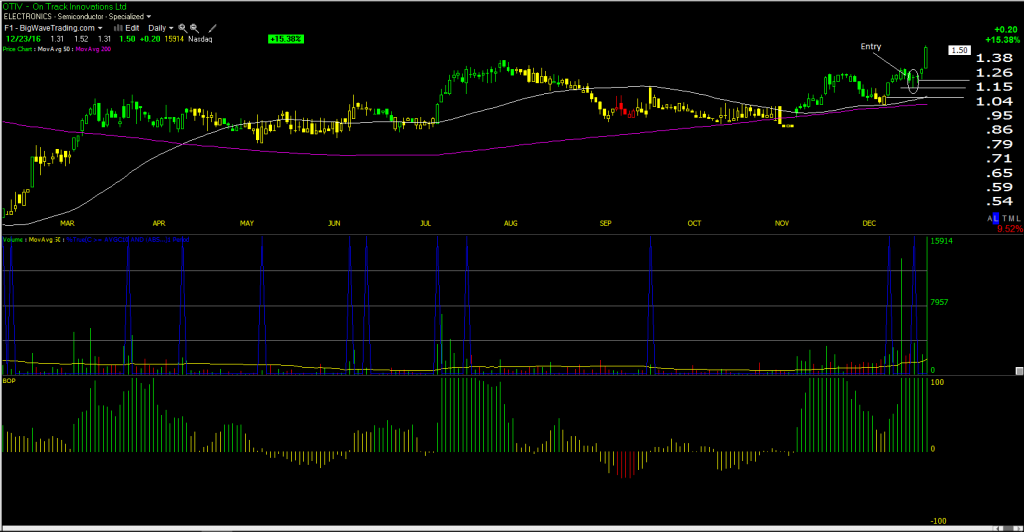

Recent Long Positions:

MPET (+54% in less than one month) triggered a long signal off its 50 day moving average following a powerful session the day before on extremely large volume. The stock bounced right off the 50 DMA on strong volume, the very next day, with a very bullish intraday reversal.

RARX (+13% in 4 sessions) triggered an IPO base long signal as it broke out above the recent consolidation on heavy volume with my BOP indicator turning green.

OTIV (+21% in three sessions) triggered a pocket pivot point long signal as it put in a very bullish intraday reversal on heavy volume with my BOP indicator already at max-green. Do you see the heavy accumulation off the November lows?

GSAT (+28% in three sessions) triggered a long signal following a bullish intraday reversal on heavy volume off the lows of the previous day’s gap-up lows. GSAT was an oversold RSI candidate in November and turned into a momentum RSI candidate following that gap up off the FCC news. Half of my profits have already been taken at 1.88 and I have the other half at 3.00 just in case it gets up there. I doubt it will but you never know.

Older Long Positions:

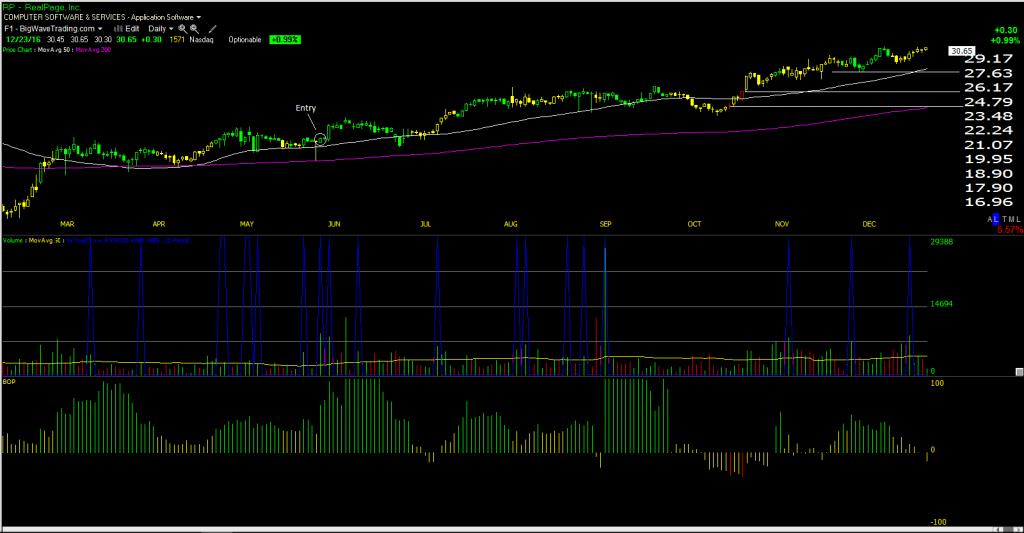

RP (+40% in seven months) triggered a long signal three days before this long signal but shook me out when all my stops were triggered shortly after. This rebuy signal was a confirmation pocket pivot point signal following a flurry of ppp signals (the blue lines that spike in the middle window pane) that confirmed that the shakeout was more than likely a one-and-done. That turned out to be the case and this green filled chart turned into a steady climber.

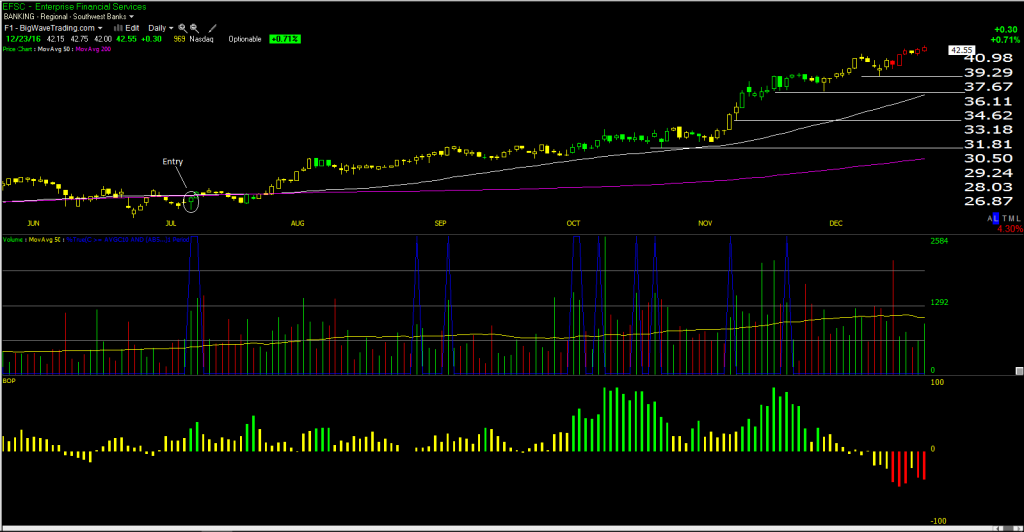

EFSC (+55% in 5 1/2 months) triggered a pocket pivot point long signal on heavy volume with BOP moving into green territory following what already appeared to be a solid bottom developing. This stock has been beyond a steady climber and I have already taken profits on it in November and December as its RSI(14) touched 80 in both months.

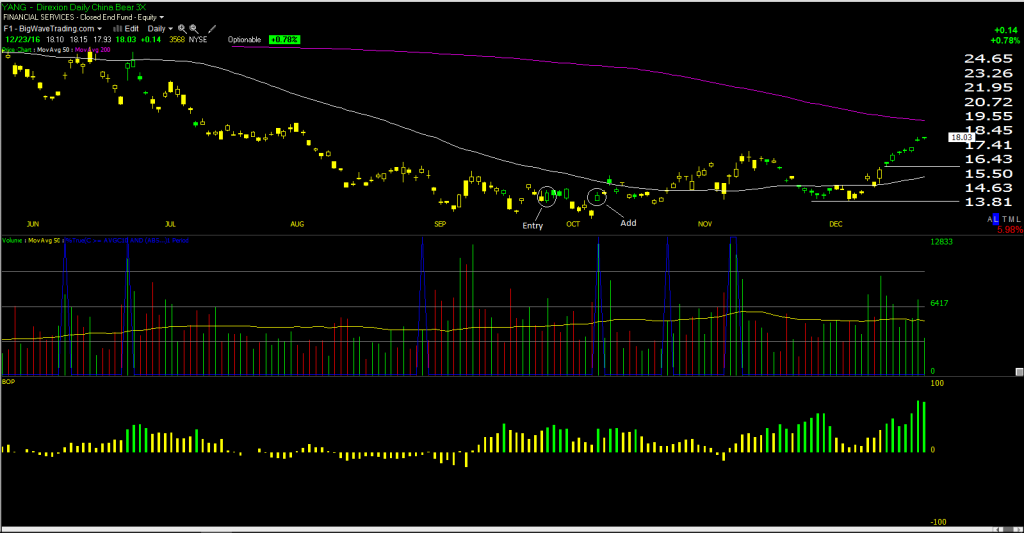

YANG (+24% in three months) has not been a smooth operator but it has done its job as a hedge well enough. YANG did not start off on the right foot triggering a cut loss immediately in October. However, due to the way that I hold hedges when I take them long off the lows (like SDOW SRTY recently) I maintained half of my position as it did not breach the 10/10 lows the next day. The very next session and add/buyback signal was generated as YANG continues to be working as a hedge against my currently extremely long portfolios.

SGU (+25% in four months) produced a beautiful long signal off its 50 DMA with a very bullish intraday reversal pocket pivot point signal on huge volume with BOP jumping to a high green level. Three days later a 3rd pocket pivot point signal in four sessions triggered with the stock breaking out to new highs on strong volume with BOP confirming the strength. SGU triggered a 20% profit taking signal following Thursday’s session as RSI(14) is now over 80 with the stock very extended in the short-term.