One more day until we get another release of the latest FOMC policy statement. Small caps led the market today gaining more than 1% on the session. We cannot say the same for the other averages as the NASDAQ ended lower and the Dow and S&P 500 limping into the close with gains. Technology stocks continue to lag the general market with Energy, Materials, and Industrials in the lead. Healthcare was the worst performing sector in the S&P 500. The VIX remains tame ahead of the Fed rate decision as many are expecting a dovish policy statement. Stick with the plan and execute.

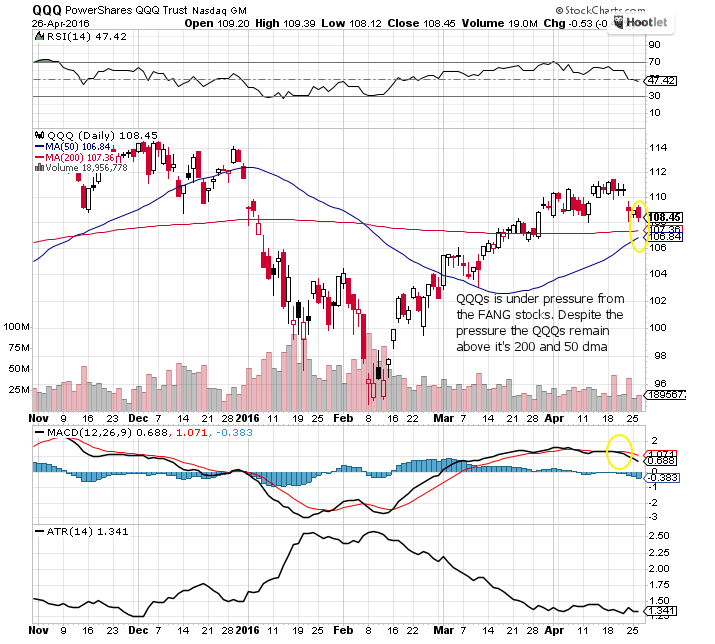

Distribution count is quite high for the NASDAQ and S&P 500. In the old days we would certainly have some concern over a high distribution count. However, since our brave new world with unprecedented central bank intervention volume has been rendered nearly useless. Price is what matters most and at the moment while we have pulled back we are not seeing the flood of selling signals we would normally see prior to any type of correction. Stick with the prevailing trend.

One potential impact could certainly be from the currency markets. Unintended consequences always stem from any Fed decision. The dollar has been somewhat weak, but remains within its establish channel. The largest portion of the Dollar Index is the Euro and it does have a bullish pattern heading into the Fed meeting tomorrow. Despite the ECB’s QE program, the hint at a dovish Fed will supersede what the ECB is doing to burn its currency. React to price not what you think may happen.

Earnings after the bell were not received well. Only EBAY pleased the market. AAPL, TWTR, and BWLD were gutted after reporting their latest quarterly earnings. AAPL continues to be a disappointment and will weigh on the overall market tomorrow.

Tomorrow will be fun. We’ll be watching with a keen eye on price.