Coming off a long weekend futures were set to push higher after positive economic news out of China overnight. It was clear for the onset sellers would regain the upper hand as stocks immediately began to sell off as soon as the market opened. After a quick rally for 45 minutes the stock market continued to dive lower. It took a last hour rally to bring the market off the lows of the session. The Dow led the way thanks to UNH while the Russell 2000 continued its putrid action finishing down 1.28%. We continue to see weakness and while today was technically day one of an attempted rally we are not overly impressed. Cash remains king as we await evidence to present itself of a potential tradable rally.

Most are looking to catch a bottom and when there are an overwhelming number of traders looking to pick a bottom we usually continue to lower. We can point to all the oversold indicators, but something in the VIX indicates a bottom may not be here like many are hoping for. VIX continues to show complacency given how we have started the year–the worst EVER.

I don’t think we are going to do much here and we have yet to see any rally to short into. Earnings season is in full swing now. NFLX and IBM reported after the bell. NFLX at the moment is still positive, but will it be the case after tomorrow’s close? Time will tell, but we are in a market where selling the rips pays off. IBM moved lower by more than 3 points after its earnings release. Will it get bought? The level of uncertainty is quite high and we are not in a position of power. We will remain on the sidelines waiting on the proper time to take advantage and win!

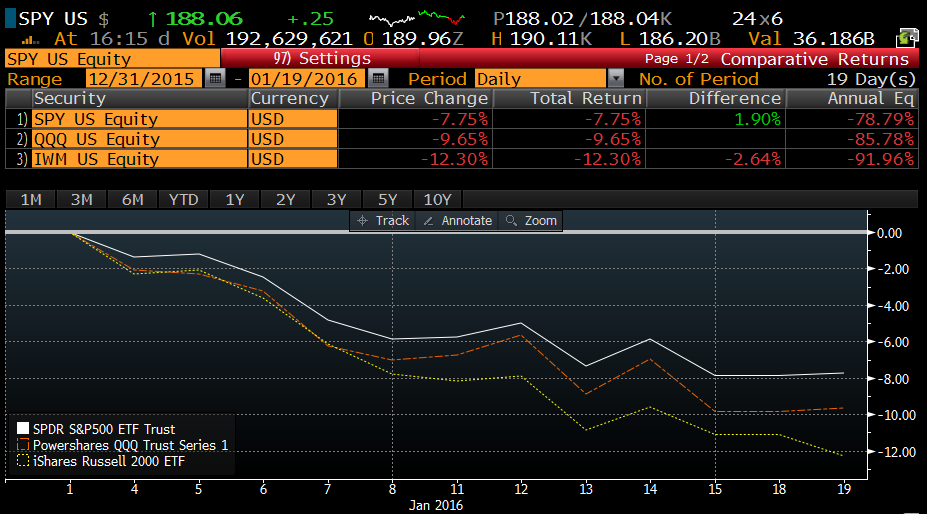

The S&P 500 is down nearly 8% to start the year and the NASDAQ down near 11% it makes it difficult, from a historical perspective to believe this year will end well for bulls. Stay patient.