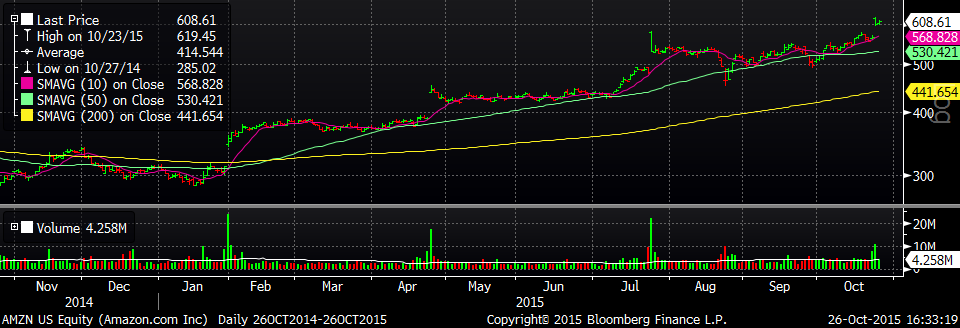

The last week of trading for the month of October and the stock market ends lower. Despite the drop in AAPL the NASDAQ was able to sneak out gains thanks to gains from PCLN, GOOGL, AMZN, and FB. Natural gas fell nearly 10% on the day as commodities in general fell across the board. Consequently, Materials and Energy were the two biggest losers within the S&P 500 as the Energy sector fell more than 2.5% on the day. Volume was light across the board. Good news for the overall market to consolidate in lower volume. However, small caps were down more than .56% and continue to lag behind its big brothers. It is clear the NASDAQ 100 is leading the way after monster earnings from GOOGL, AMZN, and MSFT. AAPL is up tomorrow after the bell. Stick with the winning trend.

AAPL is not like is other large cap brethren. AMZN and GOOGL were in better patterns running up to their earnings reports. MSFT was not in a terrible position, but at least the stock was above its 50 and 200 day moving average. Currently, AAPL sits below its 200 day moving average and was down more than 3% today in above average trade. Not that vote of confidence you have going into its quarterly earnings. Carl Icahn has been begging the company to buy back more stock and there is a strong possibility it does. At this point, they are merely treading water. AAPL is the largest position in the NASDAQ 100 and will have an impact on its performance. At this point, it is anyone’s guess where the stock moves.

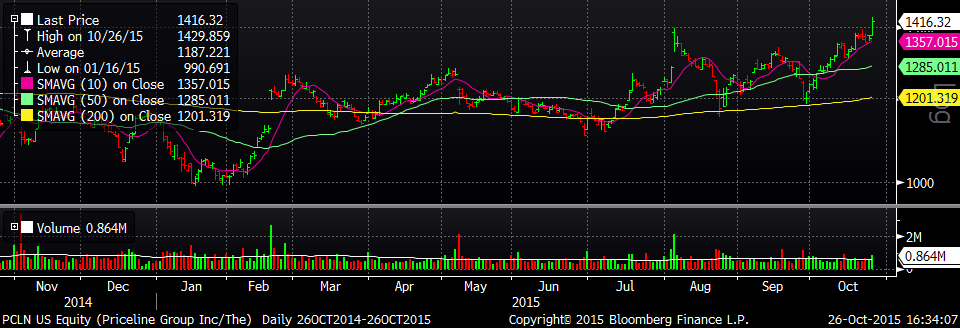

Another bright spot is PCLN hitting a new high today. There is nothing more bullish than new highs:

The light volume day is nothing new for Monday’s and is expected. So it was nice to see the market trade within a relatively tight range in light volume. Given the advance in the market we need to take a breather and consolidate these gains. We are not in nose bleeds of overbought territory, but we are getting close. It is unlikely the Federal Reserve will raise rates on Wednesday or for the rest of the year. It should pave the way for this market to push higher.

Are you prepared to take advantage of the market’s direction regardless if it is going up or down? Do you have positive returns this year? Most do not and even the S&P 500 is barely green on the year (.6%). If you aren’t returning double digits (positive) like many subscribers it is time you join. Use coupon code: SCARY to take 30% off all subscription prices. Act now because this deal is not going to last. Act by going here and using coupon code: SCARY now! Take control and start dominating this trading game.