This is not the way you want to return from a long weekend. After many enjoyed BBQs and remember those who have served those who came into the day long were hit hard by sellers. A plethora of mixed economic data hit the market, but nothing stands out where the media can say: “this is the reason the market is lower.” We care about just how prices ended lower for much of the market. This is just one day, but the heavy volume coupled with big volume certainly does not give one much confidence this market can continue to march higher. Distribution days are a part of any uptrend, but when it is this big we have to take notice. Dow Transports continue to act really weak and perhaps are now leading this market to the downside. Investors fled to US Treasuries as TLT jumped on the session and perhaps found a short-term bottom. Energy and Technology were the two biggest drags on the S&P 500. Not a surprise given the fall in crude oil prices today. Utilities were not even seen as a safe haven. Not a good day, but all is not lost. If distribution days pile up here it will be a signal this market is tired and a correction is near.

So many have been worried about an impending correction. While sentiment numbers really do not highlight it we do hear how long in the tooth is market is. It was 2011 when we had the last 10% correction. This past October was close, but no cigar. Does it mean we trade lower? No. However, we have our exit plan in place and will obey our strategy no matter the direction we head in. If short signals do arise it will be interesting to see what stocks do indicate a short signal. Could INTC be a short? Members will find out soon. In the meantime, we will continue to manage our signals and adhering to our strict position sizes. Otherwise we are opening ourselves up to tremendous and unnecessary risk.

We only have a few days left of our SELLINMAY discount of 30%. Do not hesitate and sign up today. Take advantage of the offer and find out how Big Wave Trading can help you. Our daily New Position reports detail what positions we are going long/short and what we are selling or covering. We let our members know what position size we are using to help guide you with your own risk tolerance. Simply click here and sign up!

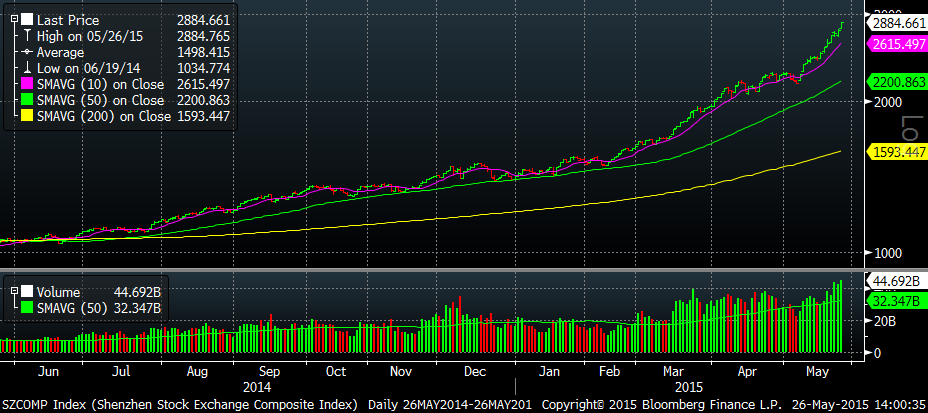

We simply cannot avoid talking about the Shanghai and Shenzhen markets. They have been on an absolute tear and they continued their advance today. Since June 20th of last year the Shanghai is up over 142%! Shenzhen blows by the Shanghai. The index is up over 177% since June 19th! We kid you not. This is much like the late 90s in the technology bubble. We are not saying either of these are in a bubble, but there are certainly similarities. Other than a rate hike it could be the Chinese markets that surprise us in one way or another.

Not the start we wanted to the week, but we simply roll with the market. If you are able to control position sizes and obey a simple exit strategy you cannot go wrong.