Today’s session was witness to heavy volume selling appeard on the street today as traders and investors return from the holiday session. Energy took a beating inside the S&P 500 today falling nearly 4% on the trading session. Crude oil sliced through $50 a barrel and is trading around $49 a barrel. On the positive side Real Estate was the only piece of the financials sporting gains. After Friday’s selling following up with a session like this is not a great sign moving forward. Big Wave Trading’s market model has moved into neutral mode. It is likely IBD will be pushing their market model into correction mode. January is not off to a good start. It is best we have a good defense and be patient when our opportunity comes on offense.

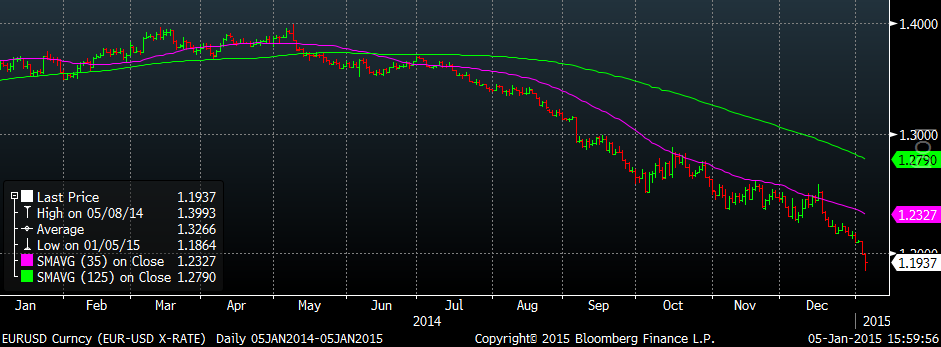

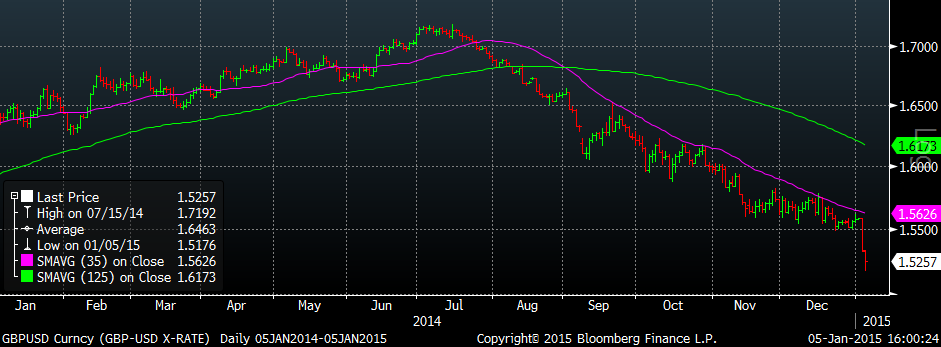

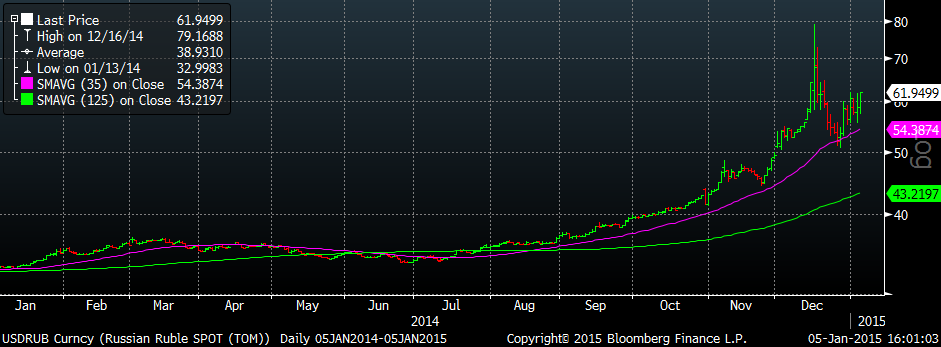

A risk many have not really talked about is the moves in the Euro and Brittish Pound. The Dollar Index hit another 52 week high today and has been on an absolute tear. Even the Russian Ruble is looking unstable once again as pressures from the slide in Crude Oil are quickly becoming a harsh reality. While it is a good thing for the consumer here in the United States anyone pulling the commodity out of the ground is going to suffer. The Euro hit a 9 year low today and if we consider 60% of our trade is with Europe their buying power has greatly dimished. It is tough to sell your goods to your partner when their currency is in a nose dive. Sure, buying a German automobile or Italian supercar has gotten cheaper, but how do US exporters survive when the Europeans buying power is slashed? Time will tell, but anyone with heavy exposure to Europe is going to have a tough time.

At the end of this week we will see how the December jobs report plays out. The fall in crude will certainly have an impact on jobs. Capital Expenditures from Oil and Gas jobs have been tremendous driver of the jobs created. Who does not know about the Bakken? Now we do not have quantitative easing to put a hyper focus on the unemployment rate. Given the lack of price inflation from commodities there is no way the Federal Reserve will raise rates any time soon. The price action is all you need to pay attention to, but the circus the Fed has created is amusing to watch from afar!

Welcome back to regular trading! Not how you want to see post holiday trading start out, but we are not about to argue with the market. This market is in tricky territory with a ton of distribution piled up. It certainly does not help when AAPL, PCLN, TSLA, AMZN, NFLX, and others are looking very shaky. Stick with the process and execute!

Aw, this was a really nice post. Finding the time

and actual effort to produce a top notch article… but what can I say… I put things off a whole lot and never seem to get nearly anything done.