Stocks rally hard as the FOMC vows to continue to keep rates low for a considerable amount of time. The market brushed aside fears over a default in High Yield land and even Russia for a day. Market pundits focused in on the Fed and what their decision would mean for stocks. Energy stocks in the S&P 500 led the index higher with a gain of 4.22%. Industrials lagged within the S&P 500. Volume was actuall lower on the NASDAQ Composite index as well as the S&P 500. NYSE Composite saw volume 1% higher than yesterday’s level. Leading all indexes to the upsdie was the Russell 2000 followed by the NASDAQ Composite. While volume wasn’t impressive the gains in the market were. Today marks the first day of an attempt rally and we will need to see a few leading stocks emerge before we get too excited over today’s move.

It is nice to see small caps take the lead from the broader market. IWM volume was impressive today as the ETF cleared Monday and Tuesday’s high. The drawback here is we have seen these big days before just like 12/9 where the ETF had a very impressive day, but failed to follow-through to the upside. It would be a welcomed sign if we are to move higher to see small caps lead the way.

Another positive for the markets was a few indexes retaking their respective 50 day moving averages. Most notably today was the NASDAQ Composite and the S&P 500. It would have been splendid if we had both retake their respective 50 day moving averages with higher volume than the day prior. However, they were able to retake them in above average volume. We cannot have everything we want right? It is anyone’s guess whether or not this is going to be sustainable or not. The holidays are upon us what are the chances we see a sizeable move lower here? Today was a solid start to rebuilding a new uptrend, but a bit more will need to trigger for us to ramp our long exposure.

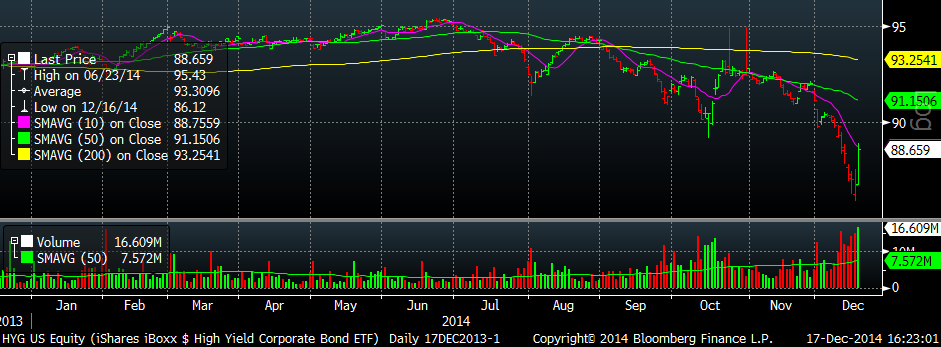

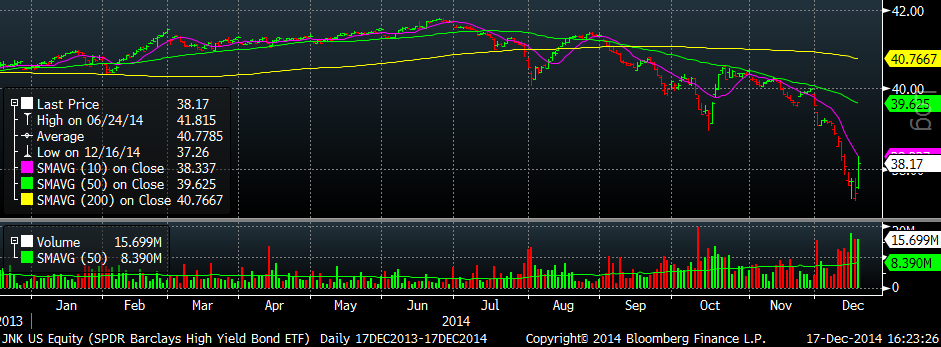

Perhaps we just witnessed an oversold rally where we have just been down in the dumps for so long we simply have a natural reaction to the upside. HYG and JNK saw such rallies today. Crude remains with a 56 handle and the leveraged drillers are still at risk of default. When it costs you roughly $85 a barrel to extract oil from the ground and you only receive $56 it is only a matter of time before it catches up to you. Risks over default still remain for these drilles. The question really is can the market look past them.

For now, we will move into neutral mode recognizing a strong day like today can change the outlook for the market. It is quite normal to get giddy for another rally to new highs, but we must focus on our process rather than a gut feel. As signals come to us we will go along with them.