As crude continues to fall worries over high yield debt are not working their way into Russia. Overnight the Russian Central Bank raised rates to stem the flow away from the Russian markets. Futures were all over the place prior to the market open, but as the opened near futures moved lower. Disappointing housing starts and building permits were not helpful. Neither was news the Markit US Manufacturing PMI was lower than expected. Mid-day the market did appear to reverse course as crude oil rebounded, but the efforts were futile as just before noon time sellers retook control and sent the market lower. Volume was up across the board as the market suffered another heavy distribution day while this market is in correction mode. Damage is wide and vast. We are pleased to have exercised caution as we remain in a danger zone for long exposure.

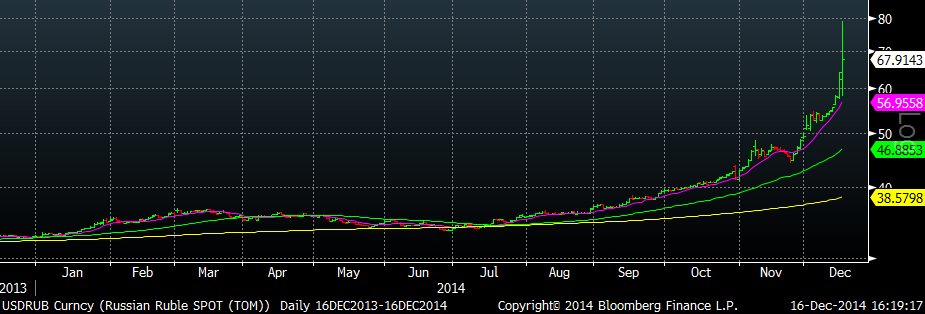

Pushing aside fears over defaults in the High Yield markets is Russia fears over its currency and overall economic health. Even AAPL shut down sales to Russia as the volatility in the Ruble has caused some serious concerns over the country. Is the West about to get the last laugh with Putin? He had been winning his campaign with the Ukraine, but with debt maturities coming due and the inability to issue paper there is a good chance Russia could default. It is not likely to be a complete repeat of 1998’s default, but history tends to rhyme.

As Russia continues to tumble out of control HYG and JNK continue to slide further. Yesterday’s action in JNK suggested a potential bottom, but today that was erased. It certainly proves attempting to catch falling knives is a dangerous game to play.

There is a glimmer of hope for stock market bulls with the FOMC meeting decision hitting the market tomorrow. Perhaps QE part 5 would help boost stock prices as the central bank will likely be concerned over deflation. Crude oil has essentially been cut in half since hitting a high in the summer. Lower prices for the little guy is a good thing, but for those who extract oil out of the ground it is not. It is even worse when you are more than 10 times leveraged. Sound familiar? The 2008 financial crisis was kicked off by over-leveraged financial firms. Now, this is not as large of an issue, but defaults typically scare market participants.

There are always two sides to a coin. One side is danger of falling prices and the other is the opportunity falling prices will deliver to us. The key is to remain patient and execute the strategy. Do not be a hero.