A short-lived rally in crude during the morning session helped boost stocks. However, a worse than expected NAHB Housing report appeared to be the catalyst for the selling across the board. Crude oil once again was lower pushing to a $55 handle. Pressure on high yield continues as fears over defaults from over-leveraged oil producers are thought to be on their way. Intraday stocks did find support, but were unable to gather enough support to snap back. The VIX index was able to close a gap from 10/17 hitting a high of 24.83. Another distribution day has pushed this market into correction mode. All last week we were cautious and we continue to remain in capital preservation mode. Today was not a good start to the week and appear lower prices are ahead.

There is no guarantee that we will continue fall from here. The NYSE McClellan oscillator is lower than -250 (Bloomberg calculation) and is in an area where we regularly see market bottoms occur. Another clue there may not be a guarantee is how the VIX was unable to hold its move today. Typically we would see the VIX remain in the green. Price action thus far is quite negative and a bounce would not be out of the question. At this point if we do bounce is it enough to resume the uptrend? While others try and figure this out we will stick with our process.

Taking a look inside the S&P 500 today we saw Utilities and Financials lead the index lower. Energy did not lead the decline, but the action in utilities is interesting as you would think money managers would be fleeing to safety. However, it appears managers were fleeing to cash as a whole as none of the 10 sectors in the S&P 500 were positive on the day. If there are issues with High Yield as a result from the collapse of oil prices financials should take a hit. The market will answer the question of whether or not this is simply a reaction to the move off October lows. The real question is whether or not your trading process can take advantage of this market.

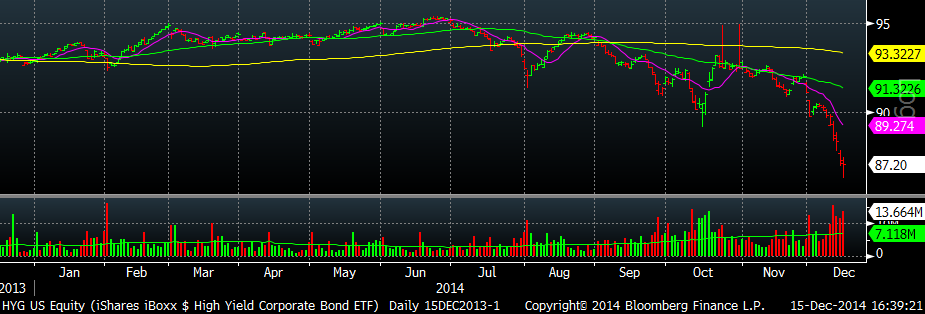

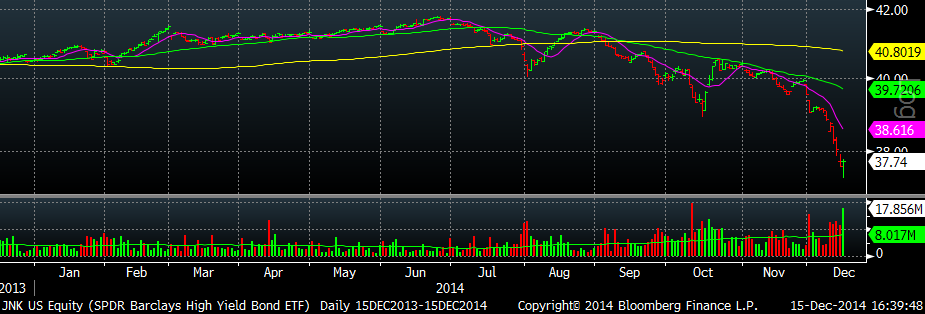

All this High Yield debt talk across the blogosphere is quite amazing. Typically a down move in High Yield foreshadows lower prices for equities. Like all mantras there are exceptions to the rule, but generally speaking stocks and High Yield markets move in similar directions. By any simple trend following strategy HYG and JNK have been a sell for quite some time. By now the downside is quite obvious, but does that necessarily mean we continue lower? We certainly can, but the big reversal in JNK does give a glimmer of hope the selling in High Yield debt is done for the time being. HYG did not get the same level of reversal, but it too was able to climb off its lows. Today’s low in HYG and JNK have now become pivotal points and should be an area to watch.

As Barron’s pointed out in its December 8th headline: “It is different this time.” We pointed out how dangerous this can be to a trader last week. Remember, the most famous version of this is the Titanic could not be sunk…is this market unsinkable as many think? Even if it is about to sink are you able to take advantage? This is where Big Wave Trading comes in handy. Profit from any market and learn how to be a professional.

Heavy volume distribution now has this market in sell mode and will become dangerous for longs. Stick with the process and always cut your losers.