There was certainly a divide in the market today as NASDAQ and Russell 2000 fell hard while the Dow closed in positive territory. A big beat for the Empire Manufacturing number was a nice surprise, but it did very little to excite market participants coming off the weekend. It was clear from the start sellers would be dominating in NASDAQ listed names. The Dow was helped by gains from CVX, TRV, and GS while the S&P 500 benefited from the Energy complex. Big warning flags were flying high with a few leading stocks getting hit hard on the session on heavy turnover. It is never a good sign to see leading stocks hit hard on volume while an index suffers a big day of distribution. Then we have the Russell 2000 in trouble with a close below its 200 day moving average. This market is on very shaky ground. We will continue with exiting where we have our signals and adding to our inverse ETF holdings.

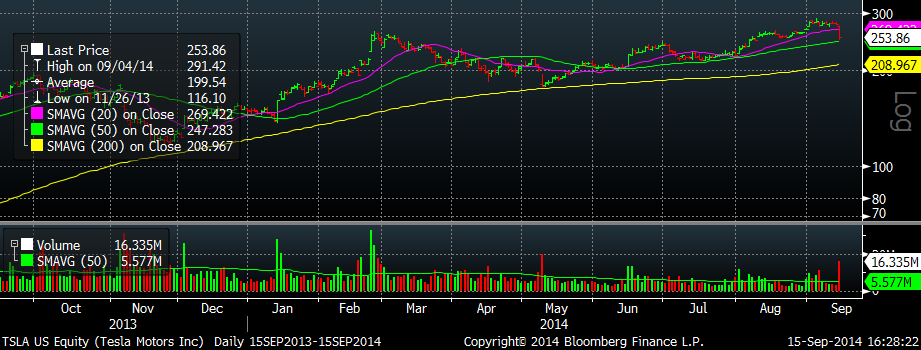

There were a plethora of leading stocks headed lower in heavy volume today causing concern over this most recent rally. Stocks like PCLN and QIHU have already rolled over and looking for more lows. Concerning is now stocks like FB, NFLX, and TSLA have been put under pressure by the today’s selling. Strong Chinese stocks like BIDU and YY are now appear to be rolling over. The excuse I was told today was portfolio managers were positioning for the Alibaba IPO by raising cash. While this could be true on some level would it have caused a max exodus out of so many stocks on the NASDAQ and Russell 2000? It is impossible to guess. However, given the big leaders like FB, NFLX, and TSLA experiencing heavy volume selling we must be weary of this market. Charts:

It is certainly dangerous to be calling a market top right here, but evidence has piled up against this rally off of the August lows. The NASDAQ now has 4 big distribution days along with some big leaders rolling over like PCLN. Even GOOGL appears to be struggling with the $600 mark. AAPL can’t pierce its most recent high even after reporting iPhone 6 sales look to be going through the roof! We have the Federal Reserve rate announcement on Wednesday afternoon and the Scotland independence vote on Thursday. To round out the week is option expiry and the Alibaba IPO. It will be fun nonetheless.

Stick to the plan and avoid making decisions on emotion.