A surprise move by the ECB by cutting rates helped push US stocks higher for the early part of the session. The surprise move buried the EURO with EURUSD plunging to lows not seen since July of 2013. By mid-morning the steam had run from the market and the highs were set. Sellers used the opportunity to push the market to new lows in the final hour. Not only were we unable to hold the highs of the session but we took out the previous day’s low. Not a very good sign in the short-term. Volume was mixed with the NYSE volume higher and NASDAQ lower. S&P 500 volume was higher on the session giving the appearance of a stall day (a form of distribution). NYSE composite flashed a day of distribution as it hit a new high today only to see it reverse lower. Leading all indexes lower was not a surprise was the Russell 2000. This uptrend is under pressure with the high volume reversal. It is best to obey your exit strategy while this market churns at new highs.

Yesterday we said not to call a top. We would have been wrong with today’s high! Of course, the reversal is another story. We have been rallying off the August lows almost non-stop. It would not surprise us here if we are to have a little more than a 1-3% pullback to consolidate the gains. Tomorrow’s job report will likely provide some fireworks early tomorrow. A key area will be today’s high and whether or not we are able to close above them. Things are choppy out there and it is during these times where it is important to trust your process. This is not the time to deviate from the strategy.

Sentiment continues to favor the bull camp this week. NAAIM exposure index did creep above 80% this week. Bearish bets did rise week over week. An interesting nugget was there was a bullish bet of 202%. I have yet to see this from this survey. AAII Bulls remained in control, but lower from last week ending at 44.67%. Bears inched higher to 23.96%. Sentiment is never a great predictor because it is not precise. However, generally speaking it is interesting to see how the crowd moves as the market does.

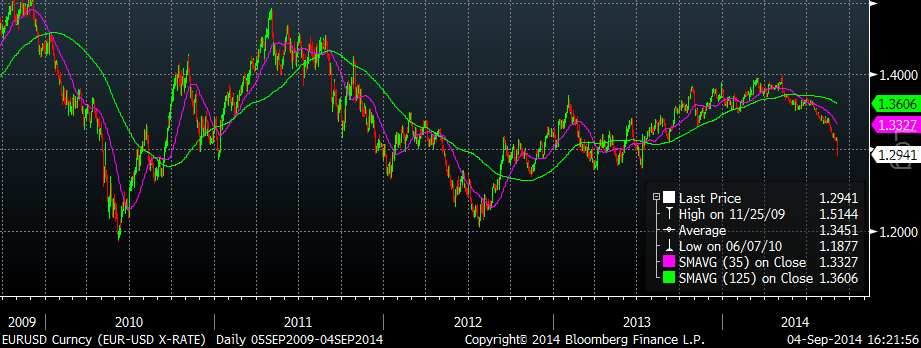

One chart for today and it has to be the EURUSD chart. Pretty amazing the move we saw in it today:

Central banks are now tasked to keep asset prices high. It is quite obvious and the further we go on the “drip” the harder it will be to come off. The Federal Reserve meets in less than two weeks and is widely expected to end QE in October. How will the markets fare without liquidity? Price will have the answer and it is a matter of you listening to it!

Have a great first weekend of fall (unofficially).