Small caps joined the party as the Russell 2000 index led all major indexes higher. It was a good sign to see the small capitalization stocks join the party. Durable goods blasted higher, but it was solely due to Boeing. Home prices stumbled with the Case-Shiller Home Price Index missed estimates. All of this simply did not matter to the market as the S&P 500 blasted ahead setting another all-time high. The Russell 2000 remains below its all-time high while the NASDAQ still has worked to do in order to surpass its all-time high set in March of 2000.

We are getting into a lofty territory in terms of overbought conditions, but this has yet to deter this uptrend from falling back to earth. We continue to have a lack of evidence this market is about to undergo a correction. In the meantime if this market wants to continue higher we will follow its lead.

Today and tomorrow are the last two days the Federal Reserve will be in the market buying treasuries. Thursday and Friday will have to survive without the added liquidity injections. It will be interesting to see how the stock market reacts heading into the end of the month without the Fed’s help.

We do know the Taper will continue with it finally ending in October. There is some debate as to when the first rate hike will occur, but it will likely be after the first quarter of 2015. After prior QE programs have ended the market has gone into a panic attack. Most notably was in 2011. Perhaps we are on better footing to be off the liquidity lifeline. Only time and price will tell. It is important to understand how to handle your entries and exits every day. You can ignore how the market may or may not act and simply follow its lead.

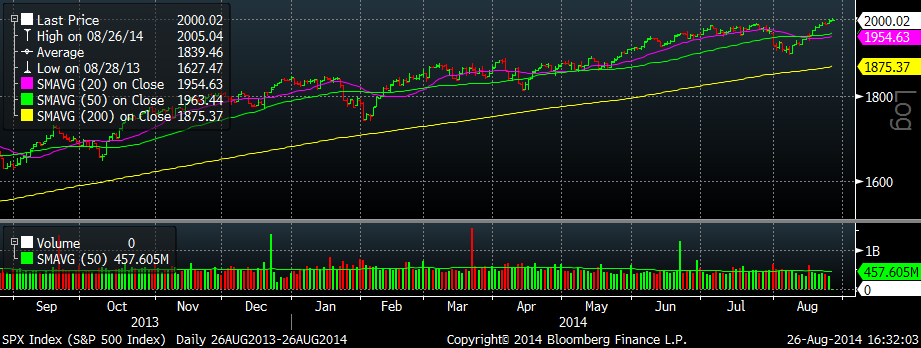

We continue to melt higher as we near the end of the summer. Volume was higher on the session which is nice to see at all-time highs. Since the low in 2009 volume has steadily declined from an overall standpoint. For whatever the reason, it simply is the case and while we can argue the why there is no point. Price continues to be the number one indicator for this market and will always be. Volume is a nice way to confirm price movement, but it is not what it used to be. In any event, the market pundits will celebrate the S&P 500 closing at 2000. To us, we are simply following the trend and will maximize our profit potential.

Here is the S&P 500 hitting new highs:

An interesting chart is investor net worth. This chart does not mean the stock market should correct here. However, it is interesting to see how bad off the average investor is:

This market keeps trucking and we will stick right with it.

just wondering when you would be posting more youtube videos. I enjoyed watching them, but haven’t seen any new ones in a while

Thank you very much for the kind comments. My sincerest apology but they are for subscribers only. I was testing the YouTube format and it was a success overall. After the initial testing phase, we have returned to making the videos available on to subscribers only. I will be releasing the videos to PUBLIC view 30 days after each one is complete. We do offer very reasonable subscription rates for the quality of the product that we deliver. This includes an amazing chat room with three proven master traders that give their stock selections live intraday. We also offer a TRIAL for a limited time. Feel free to take advantage of the offer. Aloha Doryon.