The market continues to inch higher into new high territory. Volume ended mixed on the session with the NYSE turnover higher while NASDAQ pulled in. It is hard to argue with a market hitting an all-time high on higher volume. Market pundits certainly can find reasons as to why we should have a market correction, but the fact is we continue to push higher. Even with the risk of a pullback or a deeper correction we simply do not know when it will strike. This market can push much higher than you expect. The trend is our friend and when get signals to exit this uptrend we will do so. In the meantime, continue to ride your winners and cut your losers.

Perhaps a surprise to the winning side today was financials. XLF broke into new high territory in above average today. Stocks like AIG, BAC, and MS helped push the entire sector higher. Just recently AIG appeared to be in deep trouble. However, the stock has battled back after reporting earnings. We always like to see Financials rally as it is a sign the uptrend is healthy. Look for financials to continue to add onto their gains.

Other leaders like PCLN, GOOGL, and TSLA continue to remain silent and have yet to breakout. AAPL remains at its high, but has not been able to push much higher after crossing $100. Whether it is summer trading or something else all we can do is to wait for a signal either way. Guessing is not going to be a part of our decision making process. There are plenty of other stocks we identify on a nightly basis in our New Positions report.

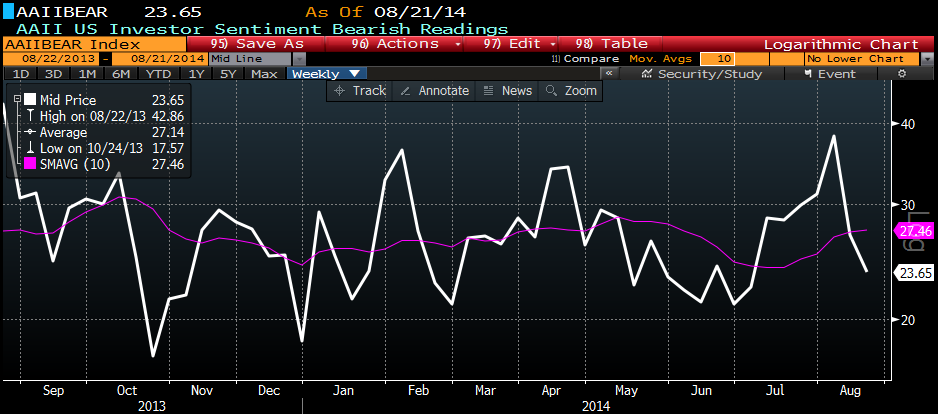

Sentiment has certainly tilted in the AAII survey, but hasn’t moved from the NAAIM standpoint. AAII Bulls moved to 46% nearing an area where markets typically have a correction. AAII Bears stand at 24% this week. While it is not at an extreme, the reading is still quite low. What is interesting is while the AAII investor has gotten bullish those responding in the NAAIM Exposure Index have not. The exposure index ended the week only 56.77% invested. Not overly bullish by any stretch of the imagination. Could it be the small investor is right while the institutional active money manager is not? That would be different. Time will sort this out.

Next week is our last week of summer. One more weekend until the unofficial end to the summer. Get out there and enjoy it.