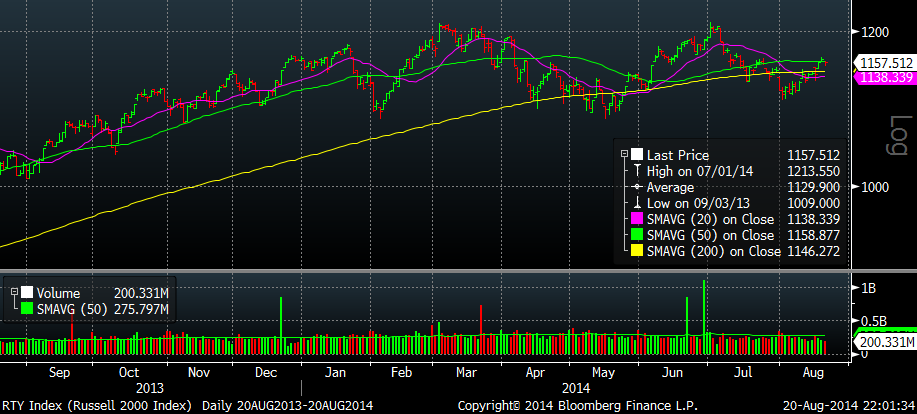

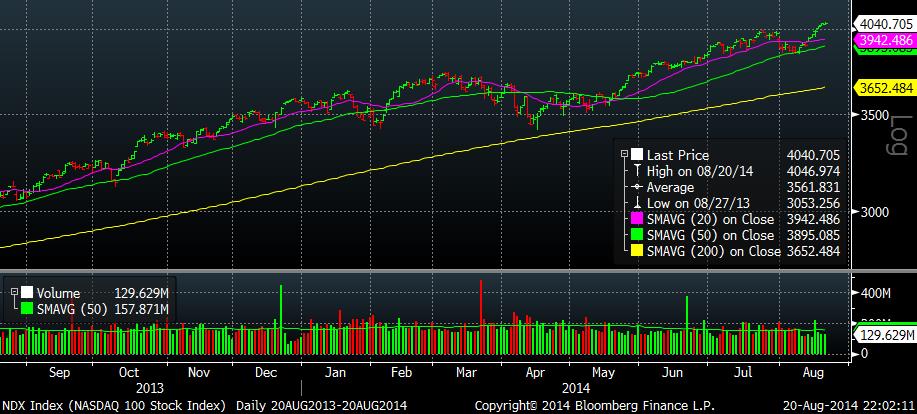

The story of the session was the volatility following the release of the FOMC meeting minutes. For much of the session leading up to the release the market was relatively quiet. Immediately following the release the market initially moved lower only to find buyers willing to step up and push the market back to the highs of the session. Late day selling knocked the market off its highs, but with lower volume on the session today was more of a consolidation day. Russell 2000 continues to lag whereas our other major indexes continue to remain strong. Not a bad session by any stretch of the imagination although it could have been better.

Taking a look at the Russell 2000 the index continues to lag the major indexes like the NASDAQ 100. The index of small cap stocks is below its 50 day moving average. It would be nice for the Russell 2000 to make a run for its July high and take over leadership. For this uptrend’s sake it would be a welcomed sign if small cap stocks can join and lead the rally. Otherwise, gains we see will be somewhat limited than we are used to. Take what the market gives you, but it would be nice if it gave us some great gains!

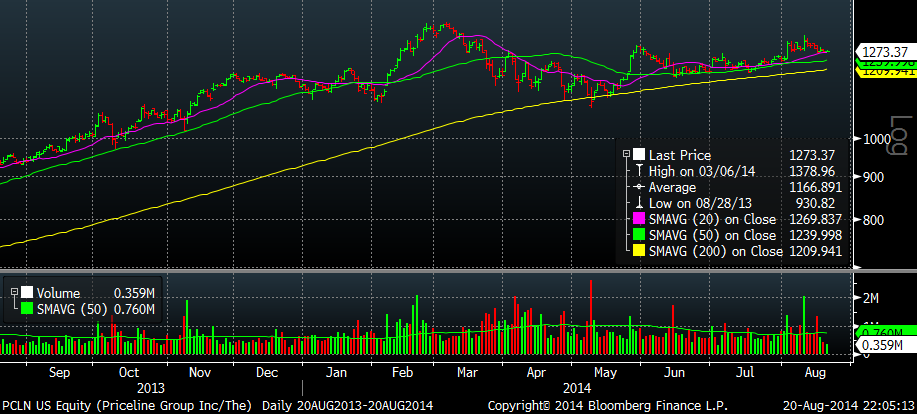

There are few stocks on our radar. Like CAVM we must be on the lookout for potential big runs by stocks who demonstrate characteristics of past big winners. FB continues to consolidate its gains from earnings. The stock remains in a bullish pattern. PCLN continues to move sideways after its earnings release. WUBA is another stock we are paying close attention to. Tomorrow afternoon it will release its latest quarter earnings and while today’s action was not great it still has potential to breakout. Check out their charts:

It would have been preferable we would have seen the market pullback in light volume today. Oscillators still remain overbought while other indicators are approaching overbought territory. Given it is the end of the summer volume should remain on the light side. Will it keep prices from launching higher? We’ll see.

The keys to success are: know your position sizes, entries, and exits. Cut your losses short and let your winners run.