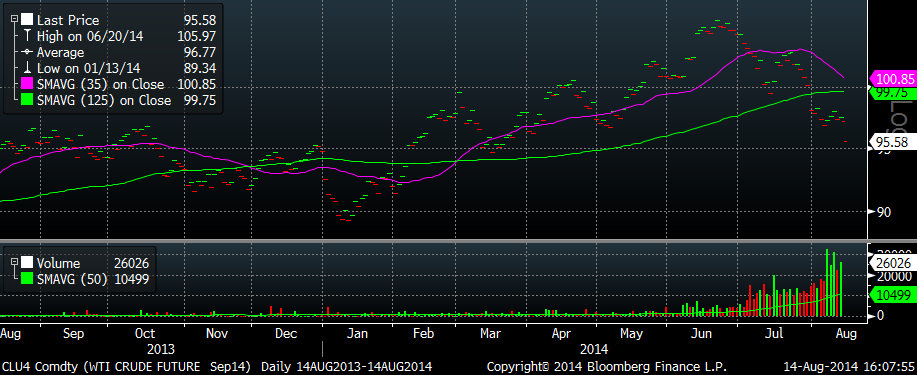

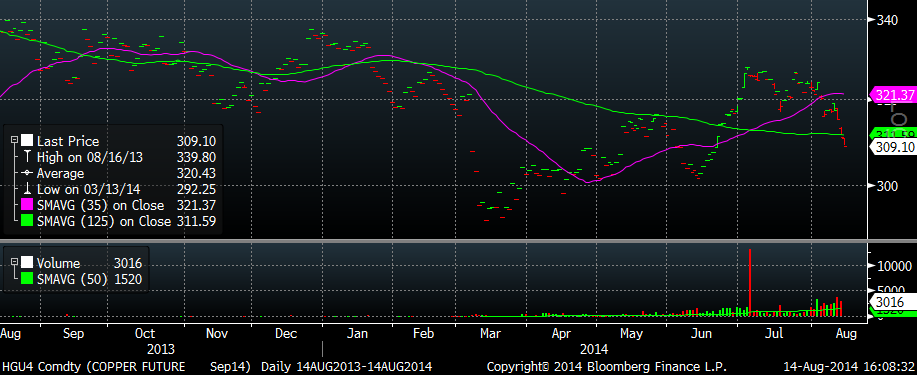

A shaky start to the trading session for stocks gave way to steady buying throughout the entire session. Leading the way once again was the NASDAQ 100 while the Russell 2000 lagged quite a bit. Just after the bond auction at 1pm EDT the 30 year Treasury bond rallied hard alongside the rest of the Treasury curve. Crude oil went the way of Treasury yields moving lower closing with a $95 handle down more than two dollars on the day. Copper too fell hard as the dollar rallied. Do we really have economic growth? Stocks did not pay much attention to the falling commodity prices or rising dollar as we closed out near session highs. Today was a solid day moving higher after yesterday’s push despite volume coming in light on the session. Price continues to move higher and we will move right along the direction the market is in.

Crude oil continues its slide from its June highs just above $107 a barrel. Given many alternatives and the rise of natural gas the demand picture for crude is not as strong as it once was. Still, it seems quite odd for the commodity to be moving this much lower if we are to get GDP growth above 3%. In addition, copper slid as well. Is there something bigger at play? The news is being priced in now and what we do know both of these commodities are in downtrends. We will find out the “why” sooner or later, but why wait? All we need to know is both are in downtrends and lower prices are likely in the coming days and weeks.

One area of strength is within the biotech industry. IBB is showing quite a bit of strength as of late despite the number of short-sellers piling into the industry. A few big name stocks within the ETF have or are poised to push higher. It will pay off in the long run to ignore the noise generated from the street. Price action will tell you all you need to know about a stock. We’ll be watching IBB closely as we push forward.

Sentiment has flipped on the AAII survey while the NAAIM respondents remain mildly bullish. Last week we saw the number of Bears nearing 40%. This week they finished at 27% for the week. It did not take long for the Bears to convert back into Bulls with Bulls ending the week at 40%. NAAIM exposure index does not pain a similar picture, but the index is still favored to long exposure. There was no change week-over-week with the index remaining at 50%. Remember, if the index is at 0% it simply means active managers are neutral with an equal amount of long and short exposure. It has been quite some time where this index has shown even the slightest hint of short exposure.

Tomorrow we’ll see the crazy song and dance when the market opens due to option expiry. It is hard to believe the third Friday is already upon us. There is not much time left to the summer so get out and enjoy the nice weekends. If you have not signed up to Big Wave Trading, take advantage of our 20% sale off both subscription levels. It won’t last much longer. Make your weekend a good one!