Global markets rally as geopolitical risk appear to diminish. The Dow Jones Industrial Average was the weakest link in the US closing with just a .10% gain. Small caps stocks led the entire market higher followed by the NASDAQ. We were moving as if we were going to see big gains across the board as lunchtime neared. Closing the market at noon would have done longs a favor as we closed off the highs of the session. While a weak close we did close positive and we still remain without a confirmation of a new uptrend. The weak close certainly does not give us a lot of confidence in a new uptrend is forming. With that said, a powerful push above today’s high with volume wouldn’t certainly help. This market is not going to be easy for many and if you stay with the process you will come out on top.

Economic data will be light until we get Retail Sales figures on Wednesday. Initial jobless claims are always on Thursday. There really is not any, what CNBC would call market moving economic headlines to hit the wires this week. We do have options expiring on Friday, but nothing to act as a catalyst to move this market higher or lower. Geopolitical risks remains with Iraq, Israel, and Ukraine simmering. They could always pose a headline threat. If you simply ignore the noise of what may or may not happen and strictly follow price patterns you can outperform the market. Come join Big Wave Trading and win with us.

Two market leaders we are watching are PCLN and NFLX. PCLN is breaking out after earnings today. Not the strongest of moves given the end of day action, but it still above its handle high. The big question will be will it reverse these gains like many other breakouts we have seen over the past few weeks? NFLX is another stock we would deem a leader. It tried to breakout from a deep base but failed to hang onto gains after earnings. Over the last month it has held up and has the potential to the run. The key is not to think about the possible outcomes. Set a plan and execute.

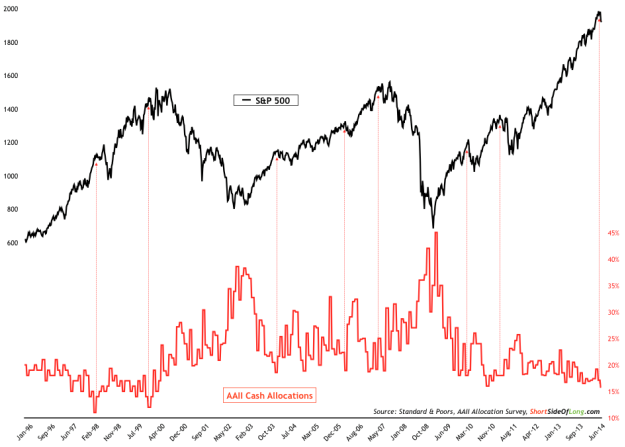

An interesting chart was posted by ZeroHedge earlier today regarding the retail investor. Using the cash levels of AAII investors it appears cash levels are near if not at all-time lows. Typically we see these at or near market tops. Are we at a top? It is anyone’s guess and we aren’t about to abandon our proven process to guess a top. We could very well push higher. However, this chart is intriguing because it highlights the need to have a plan. What if the market does top, do you have a plan?

The next few days will be important to see if we can move higher or do we simply resume the downtrend. Keep a close eye on market leaders and their price action.