Massive selling today pushes the Big Wave Trading market model to SELL mode. For whatever the reason sellers were in control for the entire day sending stocks lower in massive turnover. The S&P 500 dove through its 50 day moving average in massive turnover. Only the NASDAQ 100 and Composite indexes were to hang above their respective 50 day moving averages. Leading stocks were hit as well in big volume a sign this market is very weak. Today’s action has confirmed what we have been seeing for the month of July and that is constant churn and distribution. Simply being a blind bull and ignoring the price action of the market and leaders would have exposed us fully to today’s action. Now that we are in sell mode we will operate as such.

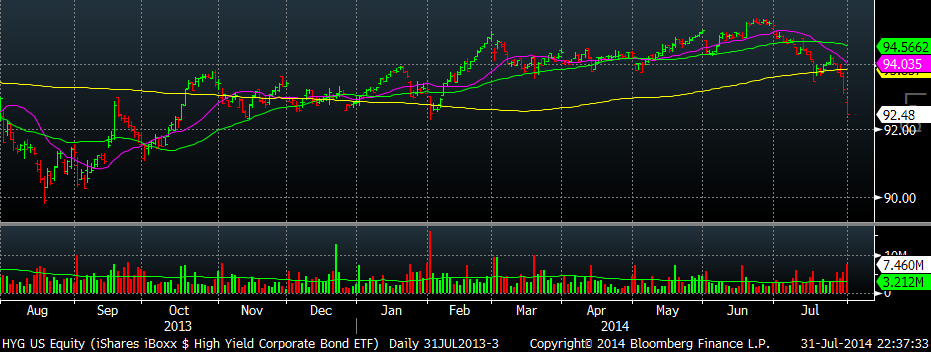

There are many items to point to in regards to the health of this market. One of our canaries in the coal mine is certainly the High Yield market. HYG and JNK have been weak for quite some time and they continued the weakness today. In search of yield many investors flooded the High Yield market with cash. Unfortunately for many, it appears it may have caught up with them as we are seeing this downtrend continue. It is easy to spot the trend change in HYG and JNK can you?

An ETF you can use to track leading stocks is PDP. Today PDP was down more than 2% today in above average turnover. A big stock leader we track is TSLA and after ending the day lower by almost 2.5% it reported earnings after the bell. As soon as the stock reported earnings the stock moved lower than higher and finally settled flat. Outside of our leading stocks is one IPO being GPRO. GPRO nearly took out its previous high set on the first of July, but it too had a disappointing reaction to earnings. LNKD was an old leader who had fallen nearly 50% off its 52 week high. The stock finished the after-hours session up 7.5%. Earnings season continues to be tough place to operate in and given the action in the overall market it highlights cash is truly king.

To touch upon sentiment for a quick moment there hasn’t been much movement. AAII Bulls and Bears were the same at 31% and those who are neutral remain in control. NAAIM active manager exposure index remains elevated as the index ended the week at 81.62%. It is almost certain these numbers will change given the action of the market today.

We have confirmation of the market changing behavior. Since 2011 the market has been able to always recover from these bits of selling. Even earlier this year in late January and early February it appeared we had seen the end only to have the market reverse to new highs. Unlike earlier this year QE is close to ending and if wage inflation picks up a surprise rate hike would all but create havoc in the market. Stick with Big Wave Trading and we’ll help guide you through any type of market. Go out and enjoy the weekend.