The NASDAQ rallied nearly 40 points off the lows of the session to close in positive territory. It appeared from the start of the last hour of trading sellers wanted to take over. However, the market had something in-store for the sellers thwarting their attempt to push the market lower. Volume was lower across the board coming off the weekend. The low volume ramp can turn into something more like we saw early last week. Tuesday’s have been very kind to the market and it would be in line with the recent trend for the markets to end higher. Day one of another attempt at a rally and so far we aren’t too impressed with what we are seeing at this point.

There is a lot of chatter over the level of the NYSE Margin Debt. Whether or not it has been overplayed remains to be seen but one look at the chart and it does appear to have topped. At this point it is simply a piece to the puzzle we call the stock market. One thing affective margin debt is certainly short-term rates. A huge spike in rates, especially caused by an “event” would certainly trigger panic selling to cover margin. Price will certainly be an indication to us before we’d ever think of ever figuring out the effects of Margin Debt. Loft levels certainly should not give anyone comfort this market can push much higher.

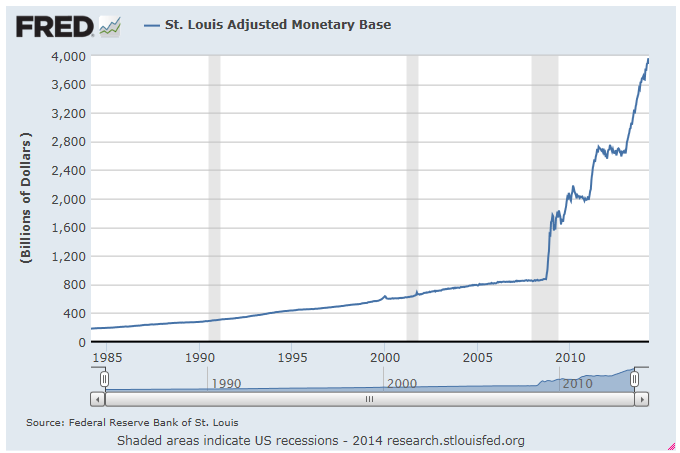

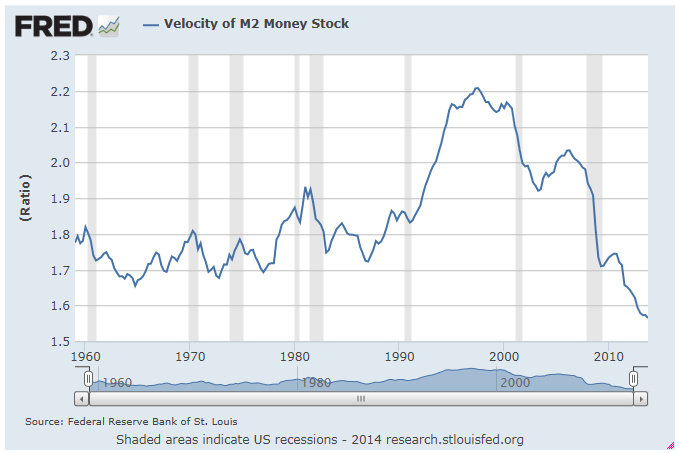

Two charts to ponder are the ever expanding monetary base and velocity of money:

No need to rationalize these two other than the money supply has expanded, but those who are getting the money aren’t using it. Hoarding is a good word for this situation we find ourselves in.

Forget the noise on CNBC, Bloomberg, and the rest. Price is our guide and it’s the only thing leading us to conquering this market.