Yesterday could have been a decent day for the market, but as we noted the volume was worrisome. Those worries were validated today with sellers dominating the market as traders and investors alike were tripping over each other to dump stock. The NASDAQ once again bore the brunt of the selling falling more than 3% on the session. Volume jumped in a big way dwarfing yesterday’s pace. Even utilities were lower on the session. The US 10 Year Treasury yield moved lower to 2.65% as money flowed into longer maturity bonds. Not a good day for the markets and we’ll stick with the hedges we have had on to insulate us from this selling. Stick with the process and we’ll capitalize on this market move.

Interestingly the number of bears on the AAII survey overtook the number of bulls for the first time in a long time. Neither bulls nor Bears outpaced those who are neutral as this market has left many dazed and confused. Bulls still dominate the NAAIM exposure index showing those who responded were 85% long. Sentiment has been bullish for quite some time and when you add that to the credit balances on accounts things begin to add up. While we aren’t about to predict where we are headed next odds do favor the downside here.

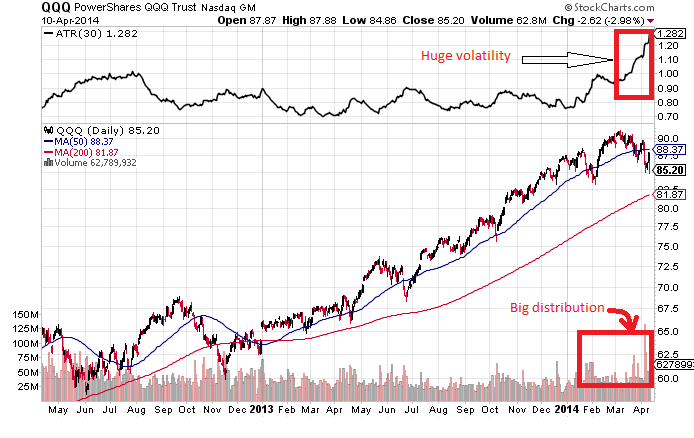

Volatility has picked up quite a bit over the last month or so. In addition, we have seen a lot of selling or distribution. Here is the QQQ:

You can see volatility spiking hard and distribution piling up over the past month. Typically, distribution does lead to market corrections. However, this uptrend has seen this market plow right through distribution. One thing we cannot escape is when trends change volatility jumps and we have a lot of volatility on our hands. Now, expected volatility as measured by the VIX is still quite tame and it simply means option players aren’t panicking just yet.

There is no need to panic especially with Big Wave Trading. Come join the community and we’ll capitalize on our opportunities in this market.