The Federal Reserve meeting minutes helped stocks push higher after the minutes revealed the central bank to be more dovish. Or so we think as these minutes were taken prior to Yellen’s “six months” comment. At any rate, we saw Monday’s highs pushed aside for higher stock prices as the market closed out at the highs of the session. Unfortunately, volume did not pick up steam as the market powered ahead. We did see a volume surge after the minutes and while it would have been nice for it to maintain the high turnover it did not. Institutions weren’t out in full force on Day#2 of an attempted rally scooping up shares. Today would have been a trend changer if volume on the NASDAQ would have been higher. Unfortunately, it was not, but we still recognize price movement and we have taken notice. If we can build upon today there is no reason we can’t at least sneak out some gains.

While we may be able to sneak out some more gains it certainly does not mean we’ll get a full fledge super rally. The VIX is really tame hinting any rally will likely be muted. It really is anyone’s guess. After 5 years of a bull market without a correction of 20% (on a closing basis) we are quite long in the tooth. Tack on the fact that margin debt and credit balances are stretched further than ever before it really is hard to fathom we have a ton of gains to get from this market. Odds are we do not have much time left on this leg of the bull market. Corrections are part of the game and while many try and guess we are correcting we simply follow our price queues. Momentum names have been hit hard over the past month and it will be interesting to see how we move forward from here. Stick with Price.

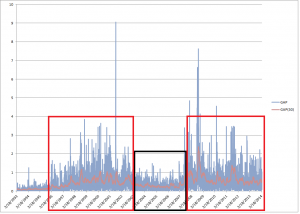

Something that we have kicked around has been the constant gaps we see in the market. Using the SPY as a gauge and it has been around since 1993 we attempted to take a look if we truly are in a world of gaps. As you can see from the chart below we are experiencing a similar market to the late 90s in terms of the market gapping. We simply took the absolute value of the market gaps on a daily basis for the life of SPY and used a 30 day moving average of those gaps.

Not much to gain other than it proves the market rhymes with history and you better well have a robust trading plan in place. Come join the Big Wave Trading community to get that plan!

Tomorrow is a new day and at the moment we have a better probability of this market resuming an uptrend. There are no guarantees in the market just probabilities. Cut your losses short!